What is e-Way Bill? eWay Bill Registration?

Before we explain, What is eWay Bill /ewaybill? How a GST e-Way helps business owners? Let’s check the latest update from the GST Council. Recently Government of India updated the latest rules on the eWay bills with few additional things.

Highlights:

- What is an E-Way Bill?

- GST e way bill registration

- How to Generate eWay Bills on E-Way Bill Portal?

- What is eWay Bill login System?

- Why e-Way Bill is required?

- When e way bill is not required?

- What is e-Way Bill’s validity?

- What is Part-A Slip?

Click Here to login to eWay Bill and generate eWay Bill: e Way Bill GST Login

Click Here to register for eWay Bill: GST e way bill registration

Recent New changes in eWay Bill and eWay Bill Generation

As on Apr 2019, GST Bill system has been upgraded with new features. Government of India has upgraded the GST e-Way Bill application with new features and functionalities. This made easy for Traders and Business owners to access and update the details. Please login to eway bill login screen.

Following are the enhancements in eWay Bill login System:

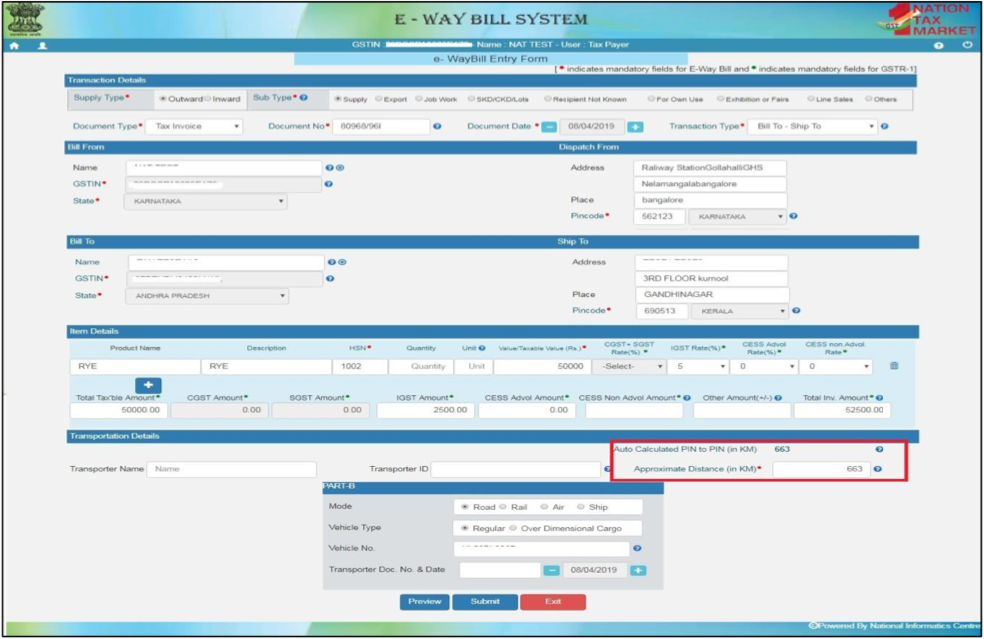

- Auto calculation of distance based on PIN Codes for generation of eWay Bill –

- eWay bill system has enhanced with auto calculation of distance between the source and destination, based on the PIN Codes.

- The eWay bill system will calculate and display the estimated vehicle distance between the supplier and recipient addresses

- Knowing the distance between two PIN codes

- Blocking the generation of multiple e-Way Bills on one Invoice/Document

- Based on the market feedback, the government has decided not to permit generation of multiple e-Way bills based on one invoice, by any party – consignor, consignee and transporter.

- Means, if a e-Way Bill is generated once with a particular invoice number, then none of the parties – consignor, consignee or transporter, can generate eWay Bill with the same invoice number.

- One Invoice, One eWaybill policy will be followed.

- Extension of eWay Bill in case the consignment is in Transit/Movement – The transporters had proposed to incorporate the provision to extend the eWay Bill, when the goods are in Transit/Movement.

- Report on list of e-Way Bills about to expire – Taxpayers or transporters can now view the list of eWay Bills about to expire in a period of 4 days

For more, please click here https://docs.ewaybillgst.gov.in/Documents/EnhancementsEWBApril2019.pdf

Create GST Invoice with ACTouch Cloud ERP.

What is eWay Bill login System?

eWay Bill login system is an Electronic Bill for movement of Goods from Supplier to Customer. As per Government / GST Council, if you are a GST registered person then you cannot transport Goods whose value is more than Rs 50,000.00 without an eWay Bill. This is mandated by the Government in terms of Section 68 of the Goods and Services Tax Act read with Rule 138 of the rules framed thereunder. This amount is for SINGLE INVOICE / BILLS / DELIVERY Challan.

Once a Bill is created, it gives a Unique ID (Bill Number) that’s to be mentioned in the document.

eWay Bill is generated from the GST Portal for eWaybill system by the registered persons or transporters who does the Goods movement before starting the shipment. Supplier or Customer can visit and generate a eWay Bill.

There are software that are available to handle them ONLINE or SMS or through API’s that are integrated with GST Portal etc. Try https://www.actouch.com and see the difference.

When I should issue an eWay Bill?

eWay bill must be generated BEFORE any movement of materials that happens from Supplier to Customer of value more than Rs. 50,000 (either each Invoice or in (aggregate of all Invoices in a vehicle/ Conveyance)).For this purpose, a supply may be either of the following forms:

- Sold to a customer / Sales Returns

- Transfer between inter-company or branches – Typically the business uses Delivery challan model.

- A material that’s SOLD is coming back for repair.

There are cases, where the eWay bill is mandatory irrespective of the total amount. So please check the GST Portal for those types of the process or items.

Why e-Way Bill is required?

Section 68 of the Act mandates that the Government may require the person in charge of a conveyance carrying any consignment of goods of value exceeding such amount as may be specified to carry with him such documents and such devices as may be prescribed.

Rule 138 of CGST Rules, 2017 prescribes e-Way bill as the document to be carried for the consignment of goods in certain prescribed cases. Hence eWay bill generated from the common portal is required.

Who and what are the pre-requisite for the eWay Bill? Who can generate the Bill?

The pre-requisite for Company or persons who generates e-Way bill is that

- The person who generates e-Way bill should be a registered person on GST portal and he should register in the eWay bill portal.

- If the transporter is not registered person under GST it is mandatory for him to get enrolled on GST bill portal () before generation of the eWay bill.

The documents such as “tax invoice” or “bill of sale” or “delivery challan” and “Transporter’s Id”, who is transporting the goods with “transporter document number” or the vehicle number in which the goods are transported, must be available with the person who is generating the eWay bill.

What is e-Way Bill’s validity?

Yes. Validity of the e-Way bill depends upon the distance the goods have to be transported. In case of regular vehicle or transportation modes, for every 100 KMs or part of its movement, one day validity has been provided.

In case of Over Dimensional Cargo vehicles, for every 20 KMs or part of its movement, one day validity is provided. And this validity expires on the midnight of last day.

What is Part-A Slip?

Part-A Slip is a temporary number generated after entering all the details in PART-A. This can be shared or used by transporter or yourself later to enter the PART-B and generate the e-Way Bill. This will be useful, when you have prepared invoice relating to your business transaction, but don’t have the transportation details.

Thus you can enter invoice details in Part A of e-Way bill and keep it ready for entering details of mode of transportation in Part B of eWay bill.

How to generate the e-Way Bill from different Registered Places of Business?

The registered person can generate an eWaybill from his account from any registered place of business. However, he/she needs to enter the address accordingly in the eWay bill. He/she can also create sub-users for a particular business place and assigned the role for generating the eWay bill to that sub user for that particular business place.

Can I consolidate the e-Way Bill for multiple Consignments?

Consolidated eWaybill is a document containing the multiple eWay bills for multiple consignments being carried in one conveyance (goods vehicle).

That is, the transporter, carrying multiple consignments of various consignors and consignees in one vehicle can generate and carry one consolidated eWay bill instead of carrying multiple eWay bills for those consignments.

Can I cancel the e-Way Bill?

A ewaybill once generated cannot be deleted. However, it can be cancelled by the generator within 24 hours of generation. If a particular Bill has been verified by the proper officer, then it cannot be cancelled. Further, eWaybill can be cancelled if either goods are not transported or are not transported as per the details furnished in the eWay bill.

When an e-Way bill is not required?

GSTN has given a provision where in certain circumstances, the eWaybills not required. Some of the cases are exempted for

- Defense sectors

- Local Custom Zone transportation

- Carrying / Returning empty Containers.

There are cases, if the mode of transport is not a MOTORISED VEHICLE too. Means bullock cart, cycle etc, then you don’t need a e-Way Bill.

How ACTouch.com can help you to become a GST compliant and generate eWayBill?

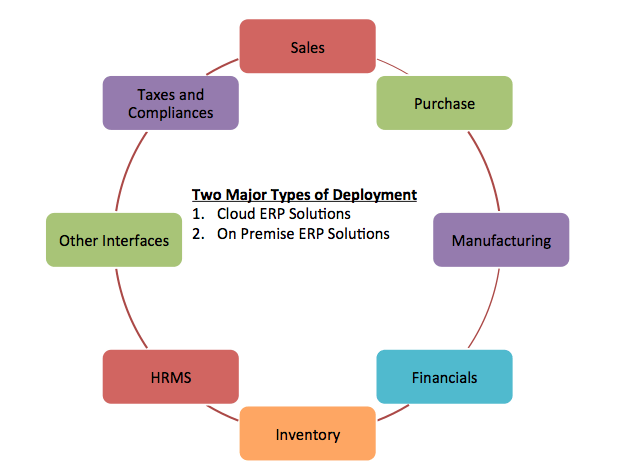

ACTouch.com is a cloud ERP system with integrated business modules like Sales, Purchase, Manufacturing, Taxes and compliance. MIS reports etc. When Government of India decided to implement GST, we modified our application to suit our needs. Below is the ACTouch.com’s application dashboard.

ACTouch.com is a 100% compliance on e-Way Bill. email us at sales@actouch.com to speak to you.

Migrate to 100% Cloud ERP Software Now and enjoy the FREEDOM | ||

| Talk to us to know more about ACTouch Cloud ERP Software NOW  |