Import Purchase Receipts (Goods Receipt notes)

We will create Import Purchase Receipts to show how to calculate the PRODUCT LANDING COSTS with a feature of

- Separate the Inventory Reporting – Goods Receipt

- Supplier invoices uploading and booking against the Purchase Order

One of the requirements from many customers is to have an accurate product landing costs as it helps to identify the product costing and helps in managing the product profitability.

Most of the Goods receipt transactions are done between Inventory Account and Supplier Payable Account. Here we don’t consider the Supplier Invoices and payment is done based on our Goods Receipt Notes (GRN).

The financial entries for this type of transaction is

- DB – Inventory Account

- Cr – Supplier Payable Account

However in few cases, the client expects to enter the Supplier Invoices and wants to pay against the same. GIT feature helps to enable this functionality. The steps to follow is as below

Step1 – Setting of Goods In Transit Account (GIT) in Purchase Settings (Purchase Order -> Purchase Settings)

Click here to get more details

Step 2 – Create a Purchase Order

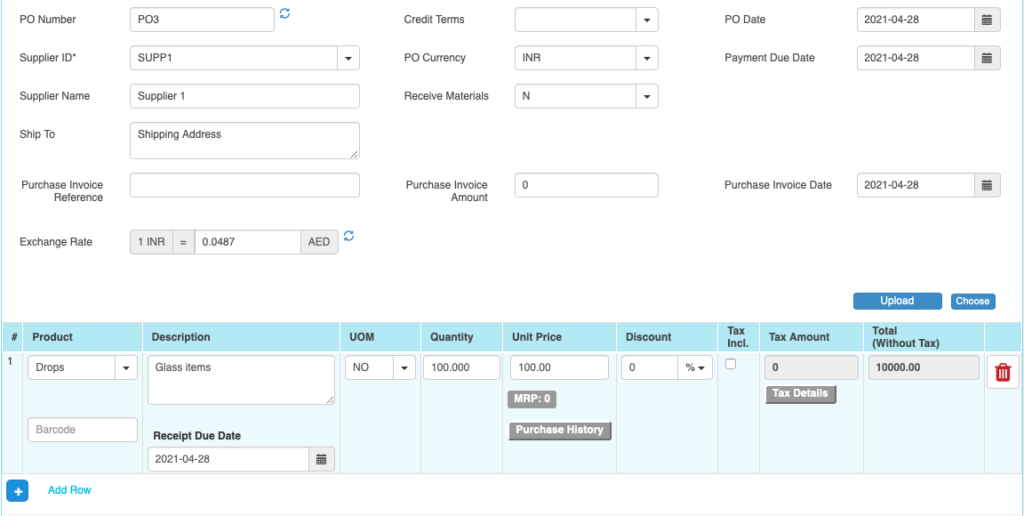

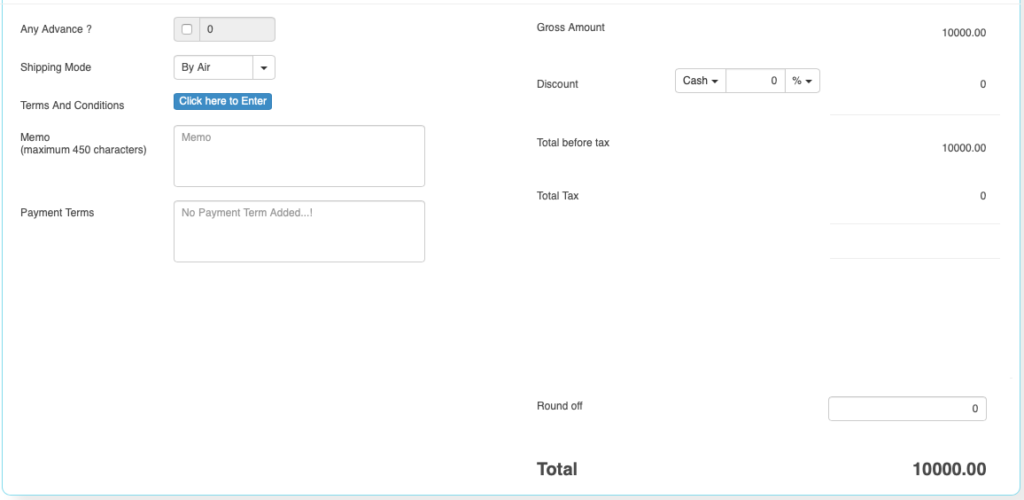

Create a Purchase Order for the Supplier with following details (Forex valued Purchase Order)

- Supplier ID and Name

- Foreign currency

- Date of Purchase Order

- Supplier Document reference and date

- Products and its Units

- Product Purchase Price

- Taxes, if any

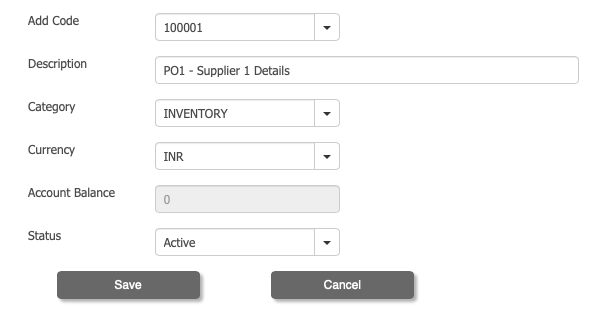

When you create a Purchase Order, Application also creates a GIT Account (if you have chosen to have each PO to have separate GIT Account). This account will be created at Accounts Master and the data is stored safe.

The account narration will be “Purchase Order No – Supplier Name”.

Import Purchase Order Creation

Create a Purchase Order as per the needs.

|

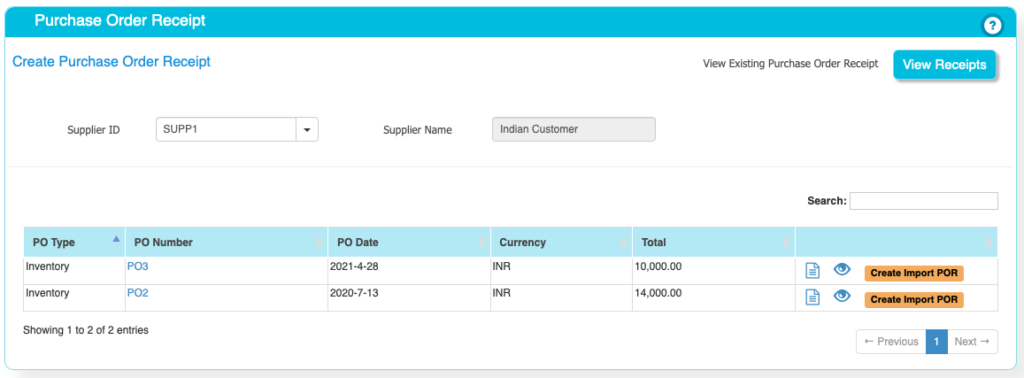

Step 3 – Receive the materials against the Purchase Order

In this step, we are going to receive the Materials against the Purchase Order sent to Supplier. We follow below steps.

- We select the PO against which we need to receive the materials

- We receive the materials and create an import Goods Receipt Notes.

Purchase Receipt dashboard

Click on the “Create Import POR” link to create the Purchase receipts. You have the options to add the taxes, shipment charges etc to Product costs. Choose the links based on the need.

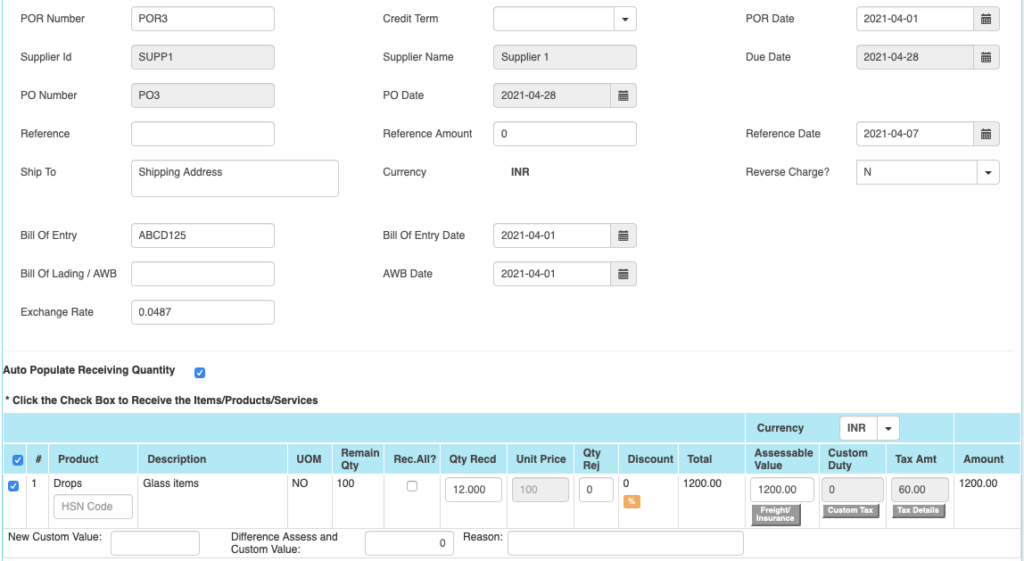

Import POR / Goods Receipt Notes

Select the PO document and receive the materials. Item wise details are entered here. It’s a simple process of select the items and its quantity received.

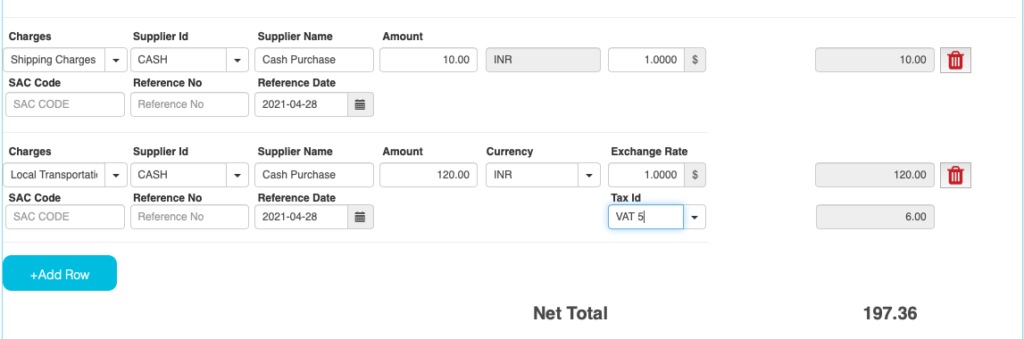

We have a feature to book the additional costs like Customs Charges, Local Logistics and transportation costs etc to Product costs.

To use this feature, follow the steps.

This will bring in the Products and its costs of the items into company.

This will pass the Financial Entries Debiting Inventory Account and Crediting Supplier Payments or Goods In Transit account depending on the setups.

For more details, send your queries to “Sales@actouch.com”.