Best way to manage your Invoices and Bills Payments

It is a common in the Business that one Customer can purchase so many items from the Retail Shops who gives him these Products on Credit terms of 30 days etc. Because this supply of materials happens for years together and many times the payments doesn’t happen on time. After a month or two, customer would give a single cheque for the partial amount for all those invoices.

Now the business owner has to raise and collect the payments against Invoices and Bills Payments. Purchase Order is a legal document and helps in tax purposes and defining the cash flow. If any differences between invoices are handled with a mutual agreement and submitting the invoice details thats shared with each other. Payment terms can be added with late payment fees or any other rules.

Export invoices are called Commercial Invoice and has different tax details to mention and handle. These are used for internal accounting purpose.

ACTouch ERP’s Bulk Invoices and Bills Payments function permits you to eliminate hours of unnecessary administrative work.

Now the challenge is how to reconcile these Bills and Invoices at the intermittent stages as the payment happens?

Let’s take an example of a customer who has purchased the Products multiple times in Jan 2019. Few of his invoices are as below.

- Invoice 456 created on 15-Jan-2019 for the amount $1200.95

- Invoice 561 created on 20-Jan-2019 for the amount $399.95

- Invoice 586 created on 22-Jan-2019 for the amount $3450.55

- Invoice 616 created on 24-Jan-2019 for the amount $120.66

- Invoice 656 created on 29-Jan-2019 for the amount $450.00

At the end of the month, customer pays a partial payment of $4000.

Now, question is how we are going to adjust this total money against each Invoice as it takes care of few invoices and not all?

Traditional way of handling of these multiple invoices

Manually adjust each invoice to the total payment amount and see how much money is remaining. Once the remaining amount is established then adjust it against the next invoice. Yes. It is possible. But it takes lot of time and its prune for huge errors. But it can be managed.

What happens, if you receive around 400 such cheque payments DAILY from different customers across the country? So the total outstanding invoices for the month could be around 25000 for all the Customers.

Yes, it’s a true story as one of our Customers had this problem.

How to make it simple? Is it necessary for vendor to worry to adjust each Invoice payment and adjust?

It is not. So we can handle the same by thinking reverse way where the total amount is adjusted automatically against First in First out (FIFO) invoices and then the next etc. This would save so much time for the vendor and helps to manage the things easily.

Bulk Invoices and Bills Payments: ACTouch’s bulk Invoice Receipts from Customer

We built a tool that helps to manage the 1000’s of invoices at one go. The business model is simple

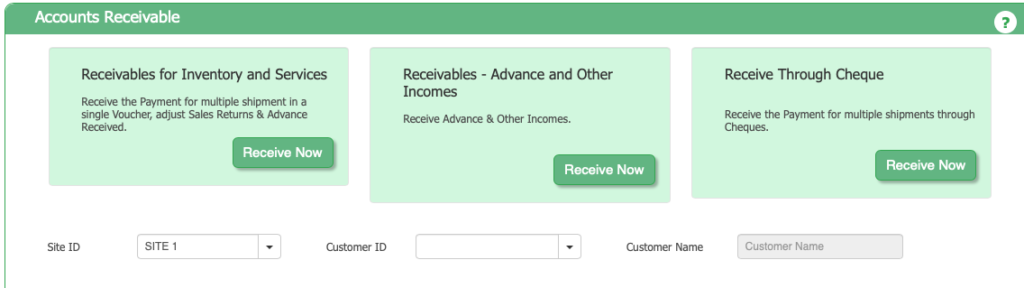

Step 1: Go to Accounts Receivable Dashboard

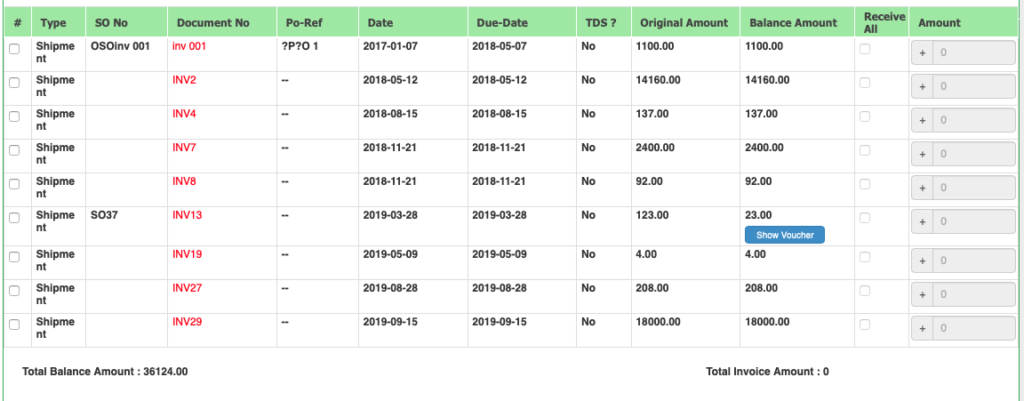

If you take the same customers list with his Invoices details, the Application would display the value as below.

In the list, you can see all the open invoices that are to be yet paid by customers. If a customer does a single payment, then we need to connect each Invoices and adjust the remaining money for next invoices.

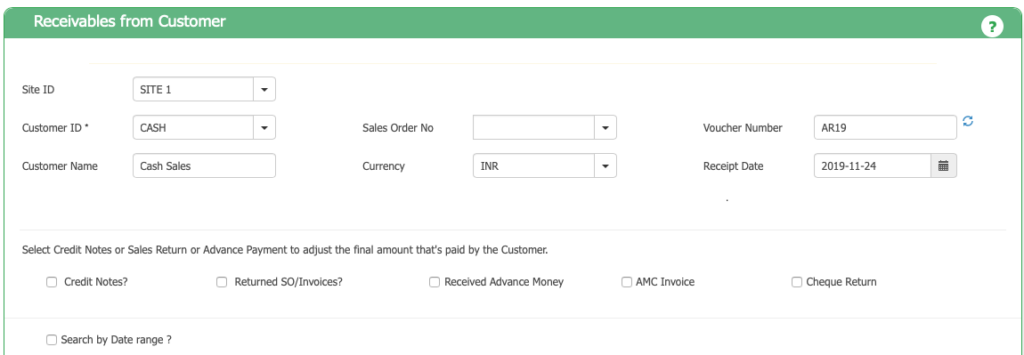

Step 2: In the bulk processing menu

We have a different approach. Business owner enters the Customer id and based on this we show the total money to be paid by him.

Step 3:

This total amount is the combination of all the below Documents and the net amount has to be adjusted.

-

- Open Invoices

- Open Sales Returns.

- Open Advance Receipt

- Open Credit Notes

- Open Cheque return vouchers

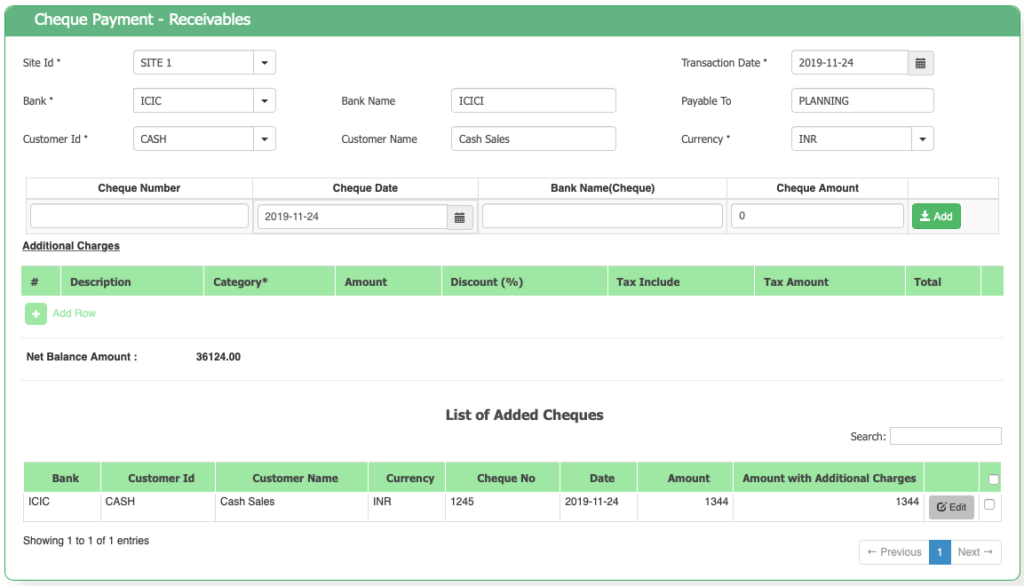

Once the cheque amount is entered, application will check in the backend all the First In First out basis documents and start passing a payment receipt voucher against this single Payment.

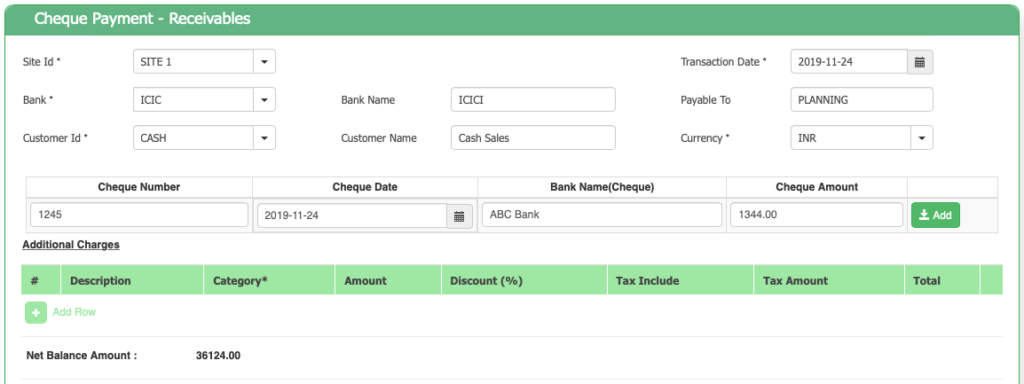

Step 4:

Once we add the cheque details and click on “Process” button below the “LIST OF ADDED CHEQUES”, the application would do the following.

- This mechanism proved very efficient as the Application keeps the record of all the transactions, advance payment receipt etc.

- In case the amount paid is more than the outstanding amount, then the difference amount is taken as “ADVANCE RECEIPT” and the respective ledger accounts are passed.

This is how its done in ACTouch ERP and its every effective.

Bulk Bills and Invoices Payments – How the Bulk Unpaid Bills Payments happens?

The basic principle for the Payment is same as Bulk Receipts process. The business case is same as there are 100’s of pending bills to be paid with few Debit notes, Advances Paid vouchers and Purchase Returns. Unless these are tracked and entered properly, it is difficult to manage.

Let’s begin with the steps to follow.

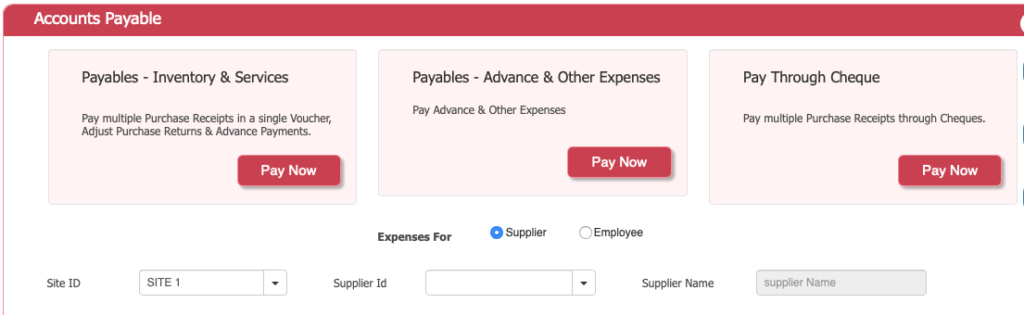

Step 1: Go to Payments Menu

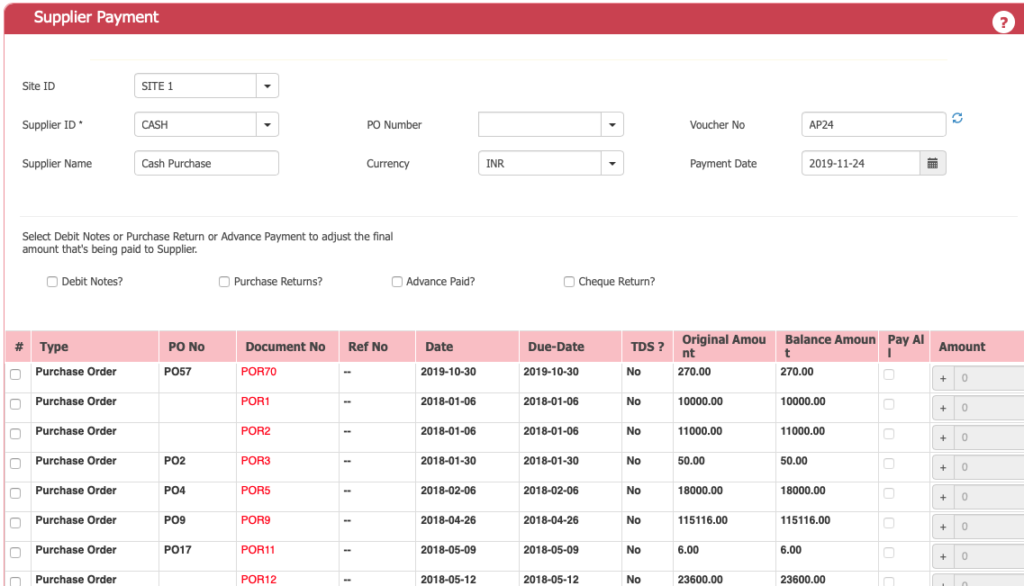

Step 2: If you see the overall payments, you can see the Individual Bills and other details

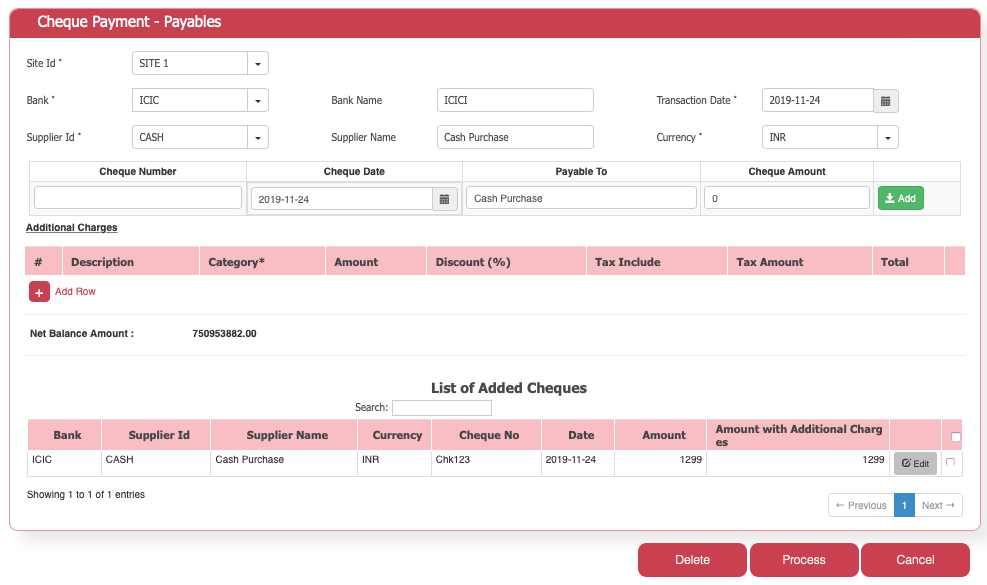

Step 3: Go to “Payment Through Cheque Menu”.

In the Payment dashboard click on “Pay Through Cheque” option and this would open a new screen.

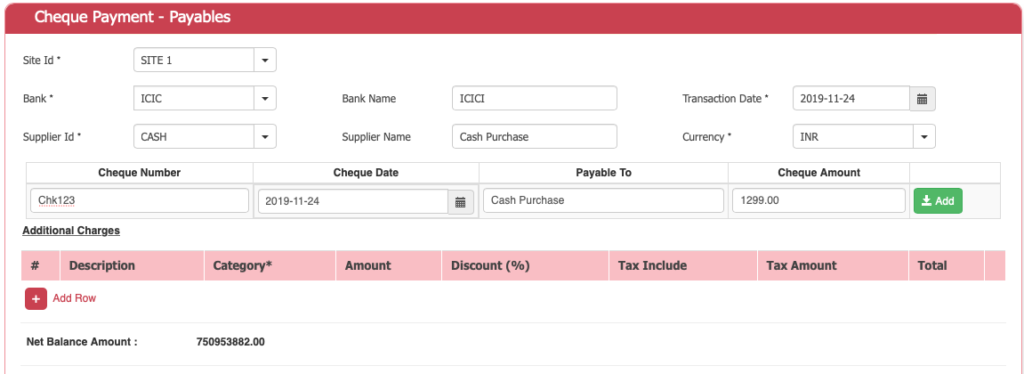

Step 4: Add the cheque number and details for the Payments.

In the menu, add there respective details. Once the data is Ok, click on “Add” button to add the cheque for processing. This Cheque would be added at the below list and from here you can process the transaction and do the payments.

Step 5: Process the payments.

Once we process the cheque, Application will select all the Goods Receipts, Purchase Returns, Advance Payments document by FIFO model and start settling it one by one. If we are paying more than its taken as “Advance Paid” to supplier and keep the record.

That’s a simple way to handle bulk Payments in ACTouch

|

FAQ’s on Invoices and Bills Payments

1. Invoices and payments

Invoices are formal bills sent by sellers to buyers for goods or services provided, requesting payment. Payments are funds transferred by buyers to sellers to settle invoices.

2. Unallocated payments

Unallocated payments are received funds that haven’t been matched to specific invoices yet, often due to missing details. They’re held until correctly applied.

3. Received payment on account journal entry

This is an accounting entry showing partial payment received from a customer, reducing accounts receivable and increasing cash.

4. What is Manual Payments?

Manual payments are non-automated transactions where funds are transferred without electronic processing.

5. What is “Recording payment on account”

To record a payment on account, debit cash, credit accounts receivable, and note the invoice number, updating financial records.

6. What is the meaning of “ERP payment”

ERP (Enterprise Resource Planning) payment refers to electronic processes within an integrated software system for managing business activities, including payment transactions.