How to book an Interest payments from BANK?

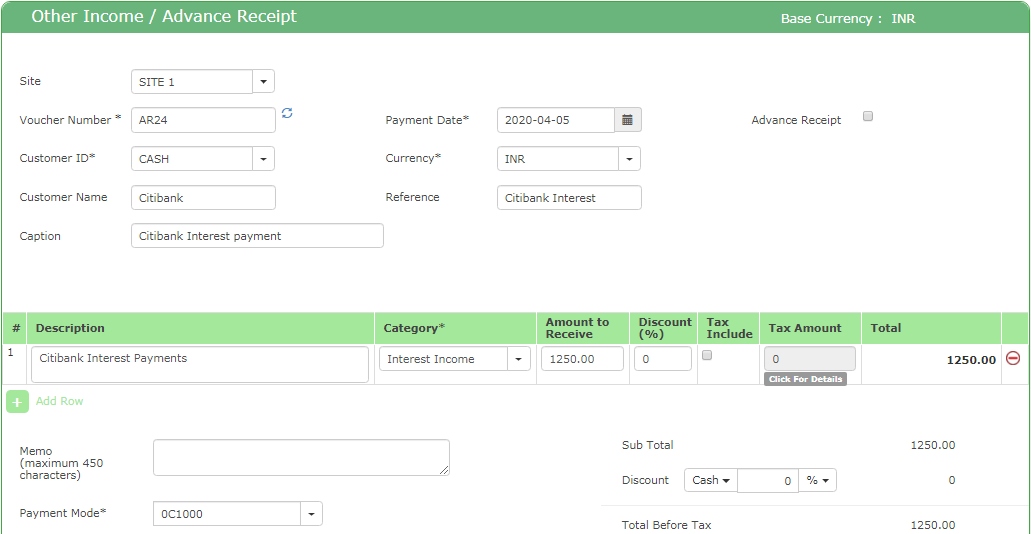

One of the important process in Bank Reconciliation is to account for the Interest Payments from Bank for the Fixed Deposit that’s done by you. Since this is business related Interest Payments and this amount should be accounted and shown in right accounting heads.

Business cases: Example, in case, you are getting INTEREST PAYMENTS ON THE FD Amount.

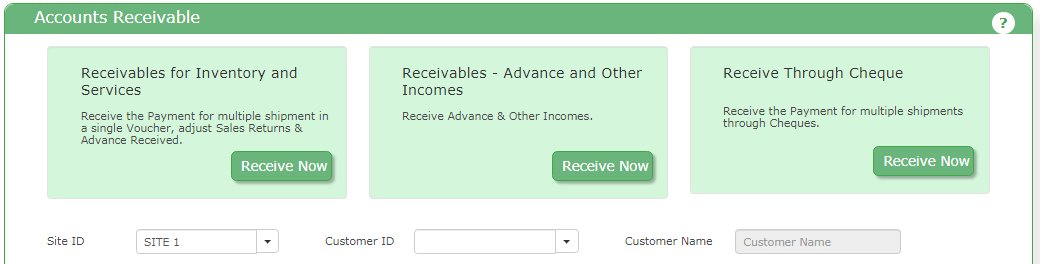

Go to “OTHER INCOME” MENU and book the money received from bank into its account.

Since this is an income, the Bank Account is Debited and Interest income account is credited.

The same approach can be used in case of Scrap items Sales with TCS amount. (This is mainly for Indian Business, where the Tax Collected at Source(TCS) to be collected and paid back to Govt.

Please contact us at sales@actouch.com for any clarifications.

You can also refer to these details for more information

- Bookkeeping process.

- Create a Sales Order with an Invoice Generation

- Advance receipt from a Customer and final settlement.

- Create a Purchase Orders and Goods Receipt Notes

Migrate to a Smart Accounting Software Now | ||

| Want to know more about ERP Features and our Services?  |

How to handle Special cases, that needs a separate process. We have explained each one separately.

- Book expenses for a Machine Purchase or Maintenance work

- Pass Journal Entry to Suspense Account to Receive Money

- Handle the PF and ESI Payments with Employee Salary