How to pass Journal entry to Suspense Account to Receive the money?

In business, you get into a state, where you don’t know who sent money? In Accounting, if any transactions are not clear, then that amount is passed through a Journal Entry to suspense account to post the transactions. Once the details are identified then the transactions are reversed. This is one of the best thing in Accounting Process / Book Keeping process.

Examples of use of this count is as below.

- While entering the Journals Voucher, you found an Amount that’s not able to attribute to a particular transactions.

- In Bank Statement, you recd a money from a Customer, but not able to identify on “who is this customer”?

- In Inventory transactions, not able to find the Cost units. Please post the transaction to a suspense account and you reverse them later.

Highlights: In this article, we try to cover the below information on Journal Entries and Suspense Accounts.

-

What is suspense account?

-

Use suspense accounts and its value in Accounting entries

-

Pass or enter a Suspense account journal entries

Migrate to a Smart Accounting Software Now

Want to know more about ERP Features and our Services?

Please note that Suspense Account also used as a reminder as this account should have a zero balance.

Steps to follow in ACTouch.com, a manufacturing ERP to manage and use the suspense account for a bank transactions. The same model could be used any other type of accounts too.

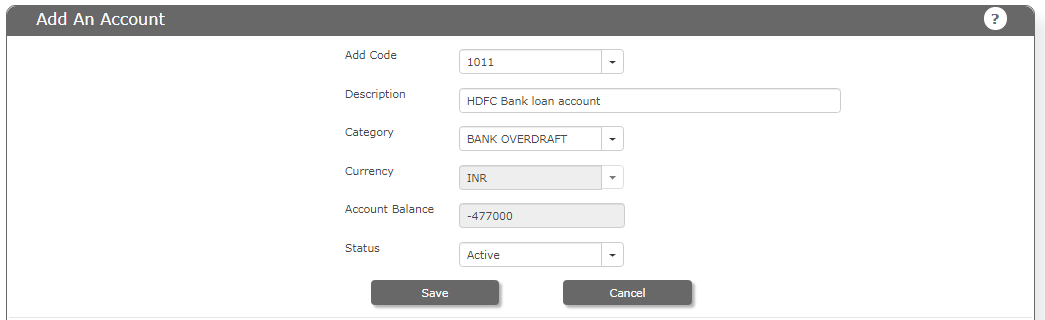

Step-1: Create a Suspense account of type “CASH”

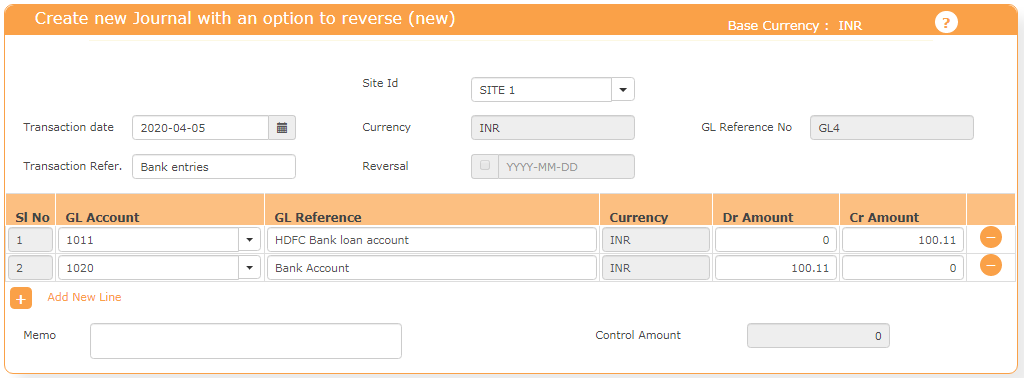

Step-2: Create a Journal entry to DEBIT the amount for the suspense amount to Suspense Account Bank

Now pass a journal entry to Suspense account and to the Bank account.

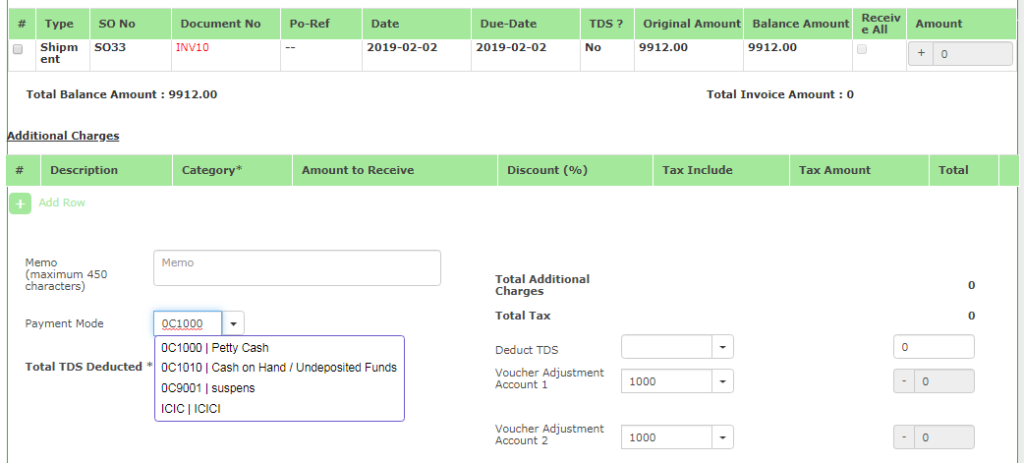

Step-3: Once amount is clarified on which Customer’s it is, go to “Accounts Receivable” menu. Here the AMOUNT is adjusted against the “SUSPENSE ACCOUNT’

Step-4: Check the “Account Statement” to see how much is remaining in the account