How to handle a Cheque Bounce / Cheque Returns?

In Indian context, Cheque is a financial instrument that ensures the Supplier / Vendor that customer is honoring his commitment to Pay for the materials that he supplied. So its important for the Customer to not to get into troubles due to Cheque Bounce or Cheque Returns problems.

Highlights

- What is cheque bounce? – This means, the cheque is returned and its not honored by the bank where you deposited for money collections.

- Why a cheque bounce happens? – There are many reasons including lack of money in the bank account, wrong person Name, Wrong Dates (Expired Cheques), Scratches on the cheque etc

- What happens if a cheque bounces – First speak to the bank and check what happened. 95% of time, bank would give the reasons on what happened (Point 2). Based on that you can speak to the person who has given the cheque to you.

There are multiple types of cheques that could be bounced or returned due to lack of money

- Today’s cheque

- Post dated Cheques – Cheques are issued with a due date / value date of the instrument more than today’s date. These are a tricky ones as on the due date, the money may not be in the bank account and cheque is bounced.

Earlier Business owners use to give cheques without any consequences in case, the money is not in their account. For the last 2 years, the Cheque Bounce is a criminal offence and the cheque issuers can be jailed without a bail too.

So business owners are very careful with their commitment to payments and monitor the cheques.

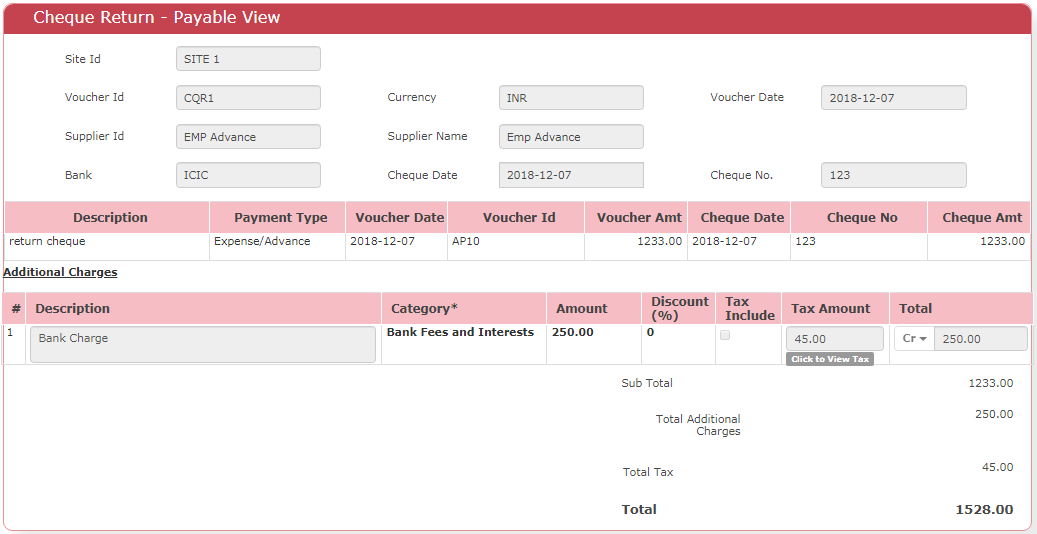

Step-1: Select the SUPPLIER and CHEQUE that’s RETURNED. This will show below details. Add bank charges and applied TAXES, if any.

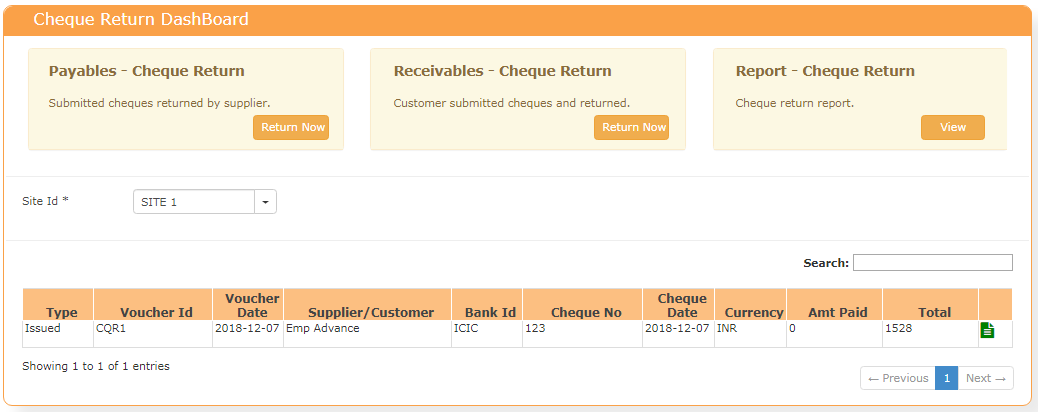

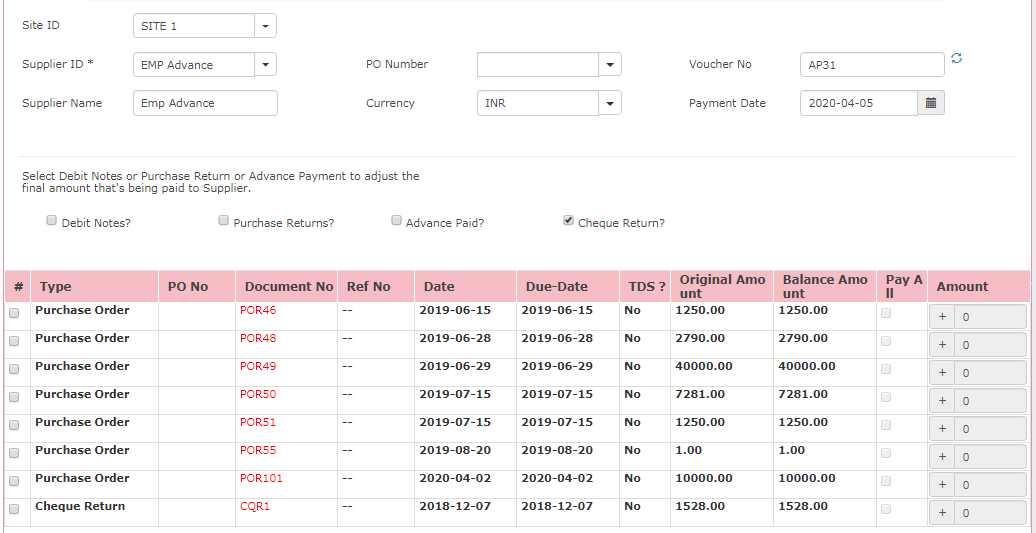

Step-2: You will create the CHEQUE RETURN VOUCHER and adjust against any other vouchers. Below is the CHEQUE RETURN voucher is shown in the AP menu.

Migrate to a Smart Accounting Software Now | ||

| Want to know more about ERP Features and our Services?  |