How to handle Bank Loans and Overdraft Payments?

Highlight:

To run or do expansion of any business, business owners need lot of money. Now these requirements are met either with Owners own money or they take Bank loan at an agreed interest payments. This money is taken for buying new machines or new building or new warehouse to storage. These investments happens as per companies business plans. So business takes Bank loans and Overdraft Payments facilities. One major difference on how Business uses these facilities is, a bank loan is used mainly for Capital investments, while Overdraft is used for working capital needs.

What is the difference between Bank Loans and Overdraft?

Bank loans as the name says is a loan from bank against a particular activities and is issued against a collateral of Assets. Overdraft is a facility that’s issued to a Business against the collateral assets, but the limit can be reset as the payment happens. For example, you have a Overdraft facility of US$ 100,000. This means, you can draw this money whenever you want and you pay the interest for the withdrawn amount only. Now you take, US$ 48,000 and the available limit reduces to US$ 52,000. When you return the earlier Loaned money, then the total amount is reset back to US$ 100,000.00. This is also revolving overdraft facility too.

Business case: It is a normal practice that customers take the Overdraft and Cash credit loan from banks and these have to be paid by by PRINCIPLE and INTEREST Amounts.

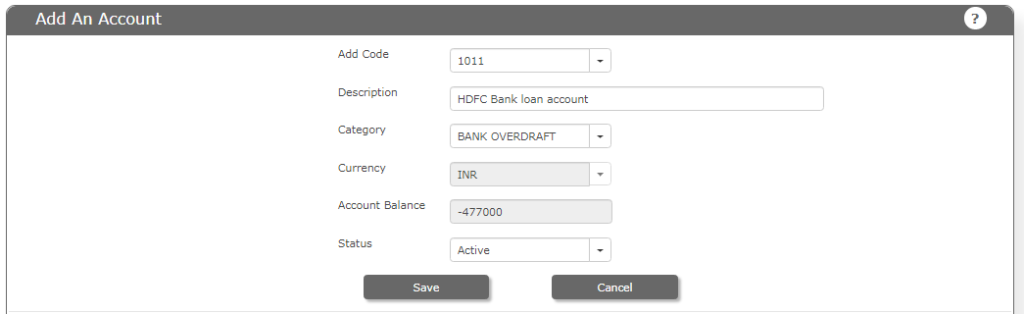

Step-1: Create an account in “Account Master” with category as “Bank” for bank accounts and if it’s a loan account, create under “Bank Overdraft”

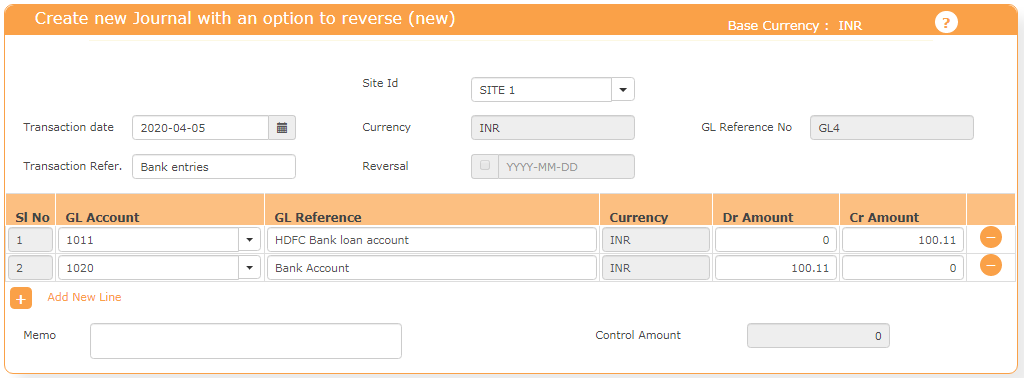

Step-2: Create a liability in the LOAN Account as we are receiving the money and DEBIT to our BANK Account.

Step-3: to General Ledger -> Journal Entry and pass the CORRECT Journal entries.

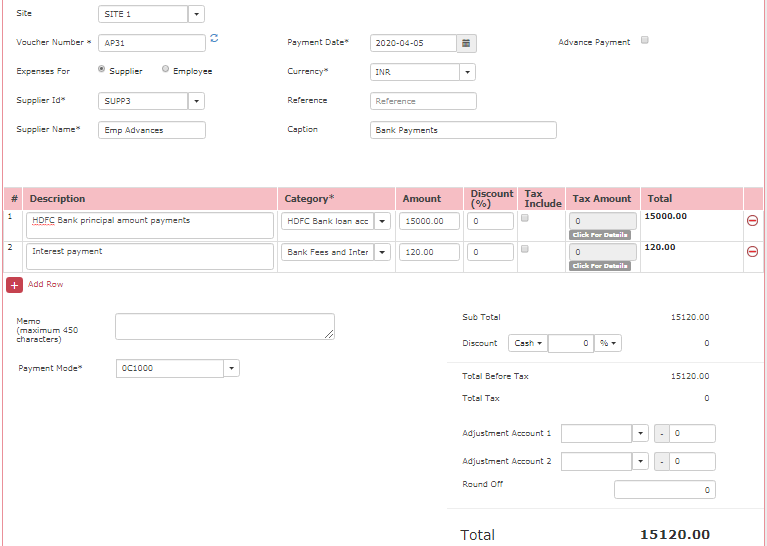

Step-4: On “Due date” pay the money to “Overdraft or Loan Accounts”.

If you are paying the INTEREST to separate account, please create that INTEREST ACCOUNT and use it.

Step-5: Now go to PAYMENTS – EXPENSE and ADVANCE PAYMENT (EAP) menus.

Please select the “SUPPLIER” and in the “Supplier name” and in “CAPTION” field, please enter the BANK DETAILS.

Step-6: Pay the money from your BANK Account.

Step-7: Account statement report: This report shows the transaction details.

Call us at sales@actouch.com for any doubts and clarifications.

You can also search for the below special cases

- How to handle Cheque bounce or cheque return cases?

- How to handle PF and ESI payments?

- How to handle Interest received from Bank

Migrate to a Smart Accounting Software Now | ||

| Want to know more about ERP Features and our Services?  |