How to handle the PF and ESI Payments with Employee Salary?

Highlights

Here we would understand more on the following.

PF and ESI payments are an important components of salary for an Employee in India. Government of India created these as Employee benefits in case of any mishap happens. This amount is “Savings in rainy days”.

PF – Provident fund – Here an equal portion every month is deducted from an employee salary and the same amount is contributed by Employer. Employer will pay this total amount to Govt towards this Employee PF Account. Government gives high annual interest to this amount.

ESI – Employee State Insurance – This is a good scheme for the employees who doesn’t have a private medical insurances.

Explain with an example on How PF and ESI are calculated? (from 1st Jul 2019 onward)

A 4% of Base salary (3.25% from Employees and 0.75% from Employers) is contributed for ESI- This is paid to Government by 15th of every month.

PF Contribution is 12% of the Basic Salary (upto Rs 15,000.00). Along with 12% is contributed by Employers. By 15th of every month, this total amount is deposited into Employee Provident Fund account.

Migrate to a Smart Accounting Software Now | ||

| Want to know more about ERP Features and our Services?  |

How to handle PF and ESI Payments in ACTouch Cloud ERP?

Follow the below case to manage your PF and ESI Payments as part of Salary. Important steps

- First we need to deduct this necessary amounts from Employee Salaries

- Later this amount with Employers Contribution to Government.

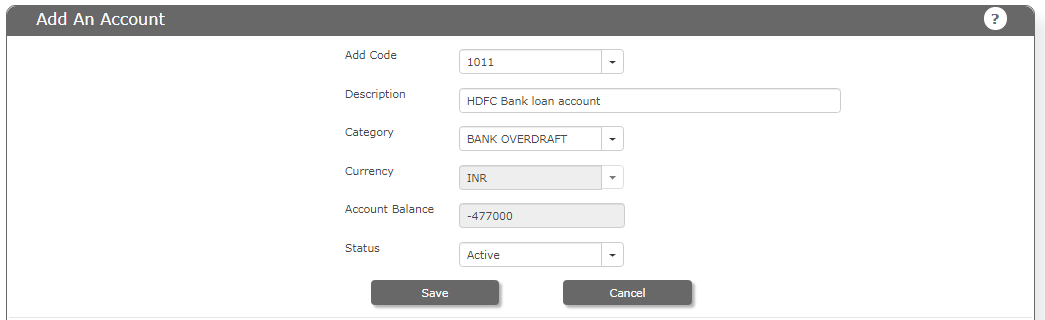

Step-1: Go to “Accounts Master” and create the PF, ESI, Professional tax Accounts.

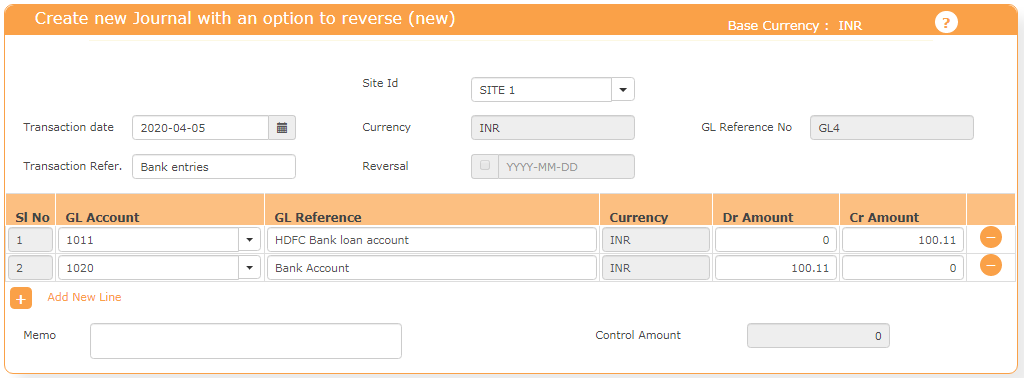

Step-2: Go to JOURNAL ENTRY and pass a JOURNAL ENTRY as below. Here we are booking the complete SALARY EXPENSES and create a LIABILITY towards the SALARY PAYABLE Accounts. In business, this MONTH’s salary is paid NEXT MONTH. But the expenses have to be BOOKED in the respective / Current month. So we do this way.

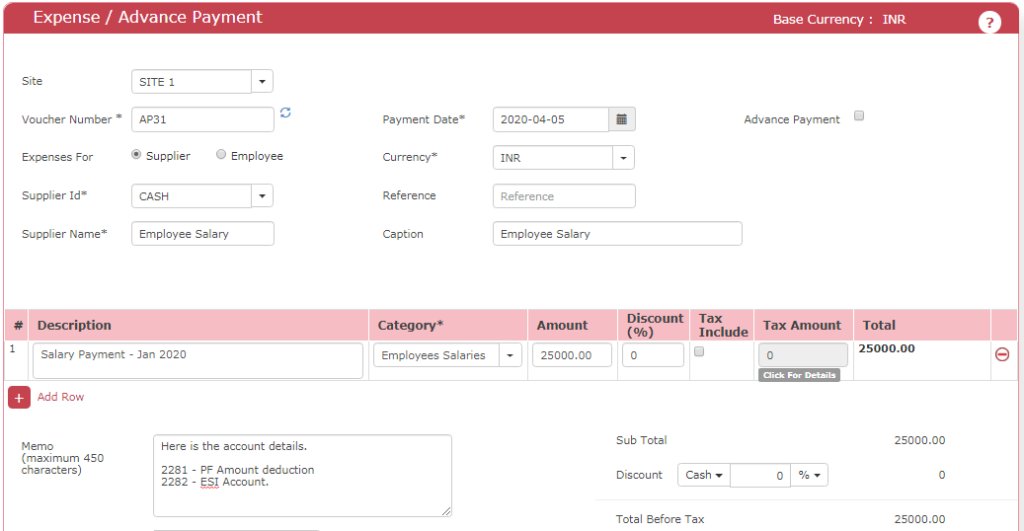

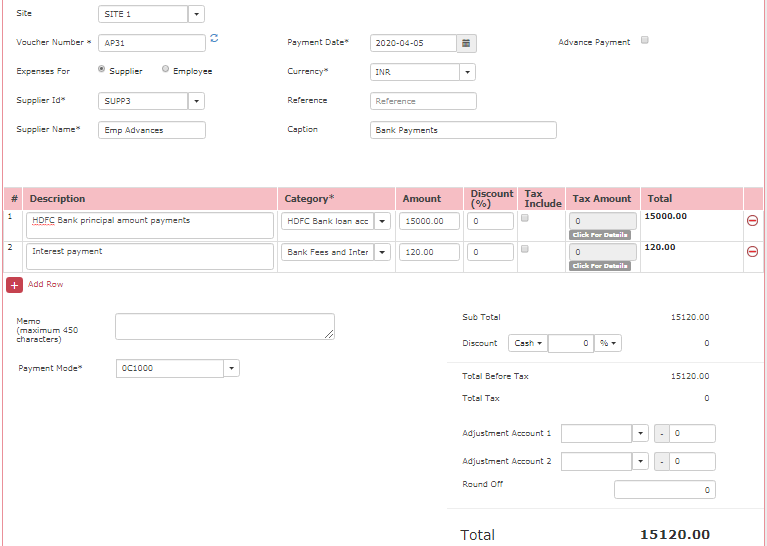

Step-3: When the actual SALARY is PAID, go to EAP menu and do the Payments against “SALARY PAYABLE” account.

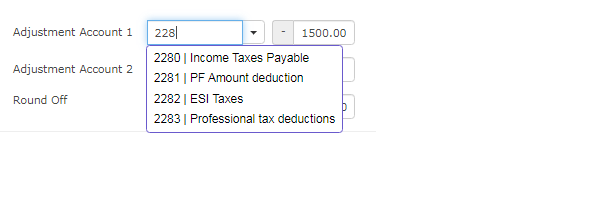

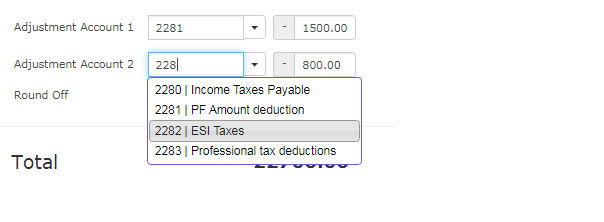

Step-4: In voucher adjustment accounts SELECT PF and PT Accounts as below.

Step-5: Now we have created the following transaction

- Salary PAYABLE Account is “DEBITED” (Earlier JOURNAL ENTRY, this account was “CREDITED”). So it is equal now.

- We have created LIABILITY from COMPANY towards PF / PT accounts

Step-6: When you are PAYING the PF Money to GOVT, create one more VOUCHER for the same as below.

This will square off the pending money that needs to be paid to GOVT and close the balances.