Delivery Challans: What is Delivery Challans?

What is Delivery Challans?

In business many times, the Supplier is not able to make an Invoice with every items delivery due to multiple reasons that’s explained below. In those scenarios, he sends the materials creating a Delivery Challan and later invoices it. So many business owners look for a “Delivery Challans Excel format” as it helps them to simplify the process and follow. We gave an option to download Delivery challans in an Excel format and modify it as per your needs.

Why this method is followed?

- In a day customer is asking the multiple items frequently and want to get it delivered ASAP through Delivery Challans.

- Customer wants one invoice per day for all the items thats delivered so that its easy for Customer to manage the Bills, Tracking etc. Some customers insists to send the material through Delivery Challan and send invoice once in a week or month.

- Many times, items are sent and it comes back as replacement or not good etc. So it doesn’t make invoice for each items and then replace it back.

- So Delivery Challan helps and makes the life of Customer and Supplier easy. After the materials sent via Delivery Challan, then invoice has to be prepared.

How Creating a DC helps Business?

- It helps to capture the time of removal of items and helps to create e-way bill which is important for Government tax controls.

- Delivery slip or delivery note is needed for transport company as an evidence of real materials been transferred from one location to another.

- Delivery Challan Number and transport details helps to trace the materials with time of delivery to track when disputes arises. e-way bill helps to link the government portal with details of times been shipped.

- Once the items are delivered at Customer place, its a customary to sign the DC with Company seal as proof of delivery. This also confirms that Vendor has delivered right Products details with right product quantity and is accepted by customer.

- In case where the Biller is different from receiver, DC will have the Consignee Details Section with Consignee address with principal supplier details etc. It also carries details like time of transportation, transportation mode and who did it?

- DCs can be converted to Tax invoice for accounting purposes and to get proportionate input tax credit too.

- In few cases, you need multiple copies of delivery with Address for Delivery. This is needed for Transporter, Customer and for tax Authority on the way.

Delivery Challans Excel Formats under GST

Most of the time Delivery Challans are important as this is the ONLY WAY to do the Business. For example in the following cases, invoice can’t be made at that time or later too. So people need an excel format that has the below features

- Material sent for Job work as Customer doesn’t know the actual cost of the work.

- Materials sent to Exhibition and comes back after the show. Delivery challans are important tool to track the items movement from the Stores to show and comes back

- Finished Goods are sent via Delivery Challans for Inter company transfers.

Delivery Challans Excel formats: How many types of Delivery Challans?

Delivery challan contents would change based on the type of activities, Industry (Manufacturing, Service or Traders). However we can identify the same in 3 formats

- Outward Delivery challan (Job work or Subcontracting) – Its prepared when items are sent out for Job Work or along with Invoice for the Transporters

- Inward Delivery Challans – Mainly for the recording of the Materials that comes in post Raw materials sent out and now we have to record back indicating “sent items have come now”

Each of the above will have the impact on the Inventory or Stock.

|

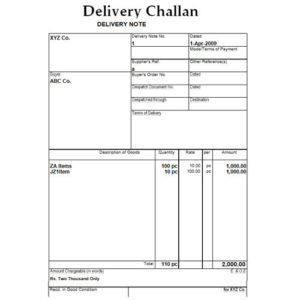

Delivery Challan details – format and contents

Delivery challan or known in business as “DC” will have its serial numbers that sequentially maintained across the financial years. It requires a physical signature and can’t be a “Auto Signature” or “computer generated ones”. Since these document accompanies the Product, the focus more towards having ORIGINAL document. Below are the field details in a DC.

- Date and serial number of the delivery challan.

- Company Name, Address, GSTN number with a clearly defined contact details.

- Name, address and GSTIN of the Subcontractor.

- HSN code for the goods. / SAC code for services, if any.

- Description of goods.

- Quantity of goods supplied.

- Taxable value of supply and the GST tax rate applied.

- Transportation charges, if any

- Place of supply, in case of inter-state movement of goods.

Please note that earlier, DC never had any financial and tax details. Post Indian GST we are expected to show these details too. Delivery challans are prepared by Stores person at the time of material goes out of his STORES. It is made either in DUPLICATE or TRIPLICATEs. Each customer follows his own formats of Delivery Challan and there is no standard formats.

For FREE DEMO, send an email to “Sales@actouch.com”

Check ACTouch ERP Documentation and find the ERP values

GST delivery challan format in excel

Download Delivery Challan in Excel Format

Send download link to:

How Delivery Challans work in ACTouch Cloud ERP?

How it works for Job work Outward delivery Challan?

You can use this menu to send the Finished goods / Work In progress items to Customer post the work is done. This helps to track the Work In progress or Finished Goods thats sent to Customer etc. In the business, Customer will send his raw materials to his subcontractor to do the activities thats not done within his factory. It could be for Assembly, Conversion of RM to Semi Finished Goods etc. So he will send a “Job work outward delivery challan” listing the items that are sent to him. The reasons for getting the Job work outside the factory premise are

- It cheap to do it outside

- No need to have additional working capacity, while the work load is very low.

- It could be too much specialised and skilled work.

- Chemical or plating or Blackening kind of work.

While making a Job Work Outward Delivery Challan, we choose an Inward Delivery Challan against which the FG is sent. Please check the video on Jobwork for a customer.

Click here for more details.

-

Check here the ACTouch.com’s ERP Features

-

How to implement an ERP Software that’s easy and quick to do?

-

Problems that are faced by an ERP implementation