How to Receive Customer Advance Payments?

In Business it is a common practice to receive Customers Advance payments as part of Order Confirmation or delivery of an items. It is done by the seller to protect his interest and ensure that Customer has genuine interest to buy the materials.

In ACTouch Cloud-ERP, you can receive the Customer advance payment by 2 methods.

- During the Sales Order creation / Direct Invoice Creation.

- As a separate Advance Voucher mode.

Here we are explaining the method of Receipt by Advance Voucher mode.

How to record Customer Advance Payment?

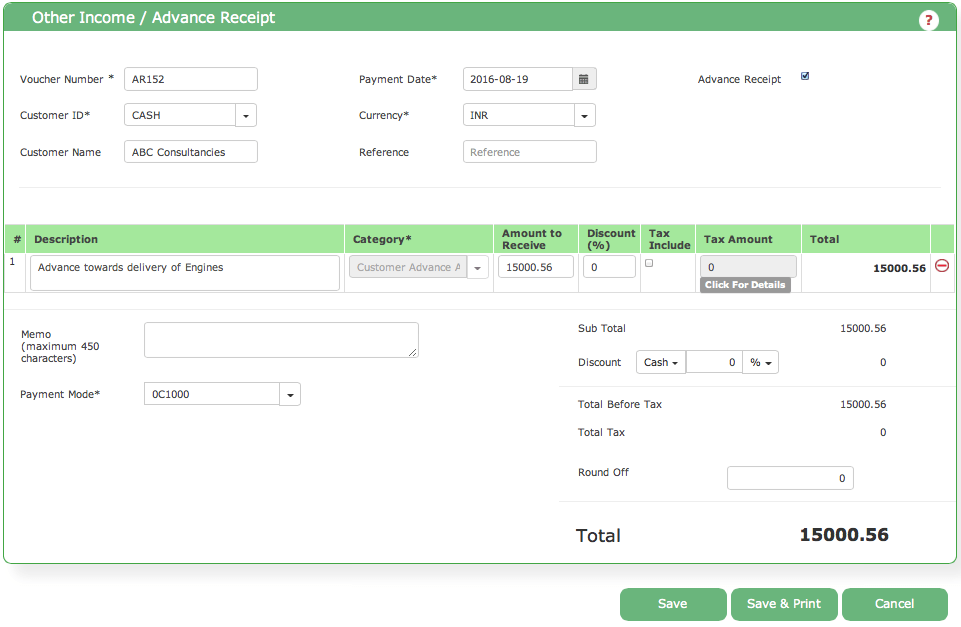

Go to the Financials > Advance Receipts & Advances and click on “Receive Now” in the section.

- Select the Customer ID from the drop down.

- Select the “Advance Payment”. This is an Important step and not to miss

- Select the Income Category and enter the Amount, Discount, Tax if any. The Net Amount will be calculated.

You can receive the money through Bank cheque, by selecting the bank from the drop down. If you have selected the BANK option, then enter the cheque number, the amount field pop up automatically. If you are receiving multiple cheques then click on Add New Cheque Details, new row appears and enter the cheque number.

Advance from customer is not shown in income statement, but in Balance Sheet as Liability. Accounting journal entries are passed to respective accounts reflect the liability of company.

Click on “Save”.

FAQ’s on Customer Advance Payments

Customer Advance Payment Journal Entry

A customer advance payment journal entry is a financial transaction recorded in a company’s accounting records when a customer makes an advance payment or deposit for goods or services that will be delivered in the future. This journal entry is crucial for maintaining accurate financial records and ensuring transparency in financial reporting. Let’s break down the components of a customer advance payment journal entry and provide an example.

Example Customer Advance Payment Journal Entry:Let’s say ABC Electronics receives an advance payment of $5,000 from a customer who has ordered a customized computer system. The company has not yet delivered the computer system. Here’s how the journal entry would look:

Account Debit Credit

Cash/Bank Account $5,000

Customer Advances/Unearned Revenue $5,000

Components of a Customer Advance Payment Journal Entry:

- Debit to Cash or Bank Account (Asset): The company receives cash or a bank transfer as an advance payment from the customer, which increases the cash or bank balance. This is recorded as a debit to the appropriate cash or bank account.

- Credit to Customer Advances or Unearned Revenue Account (Liability): The advance payment is initially considered a liability to the company since the goods or services have not yet been delivered. The liability account is typically named “Customer Advances” or “Unearned Revenue.” A credit entry is made to this account to reflect the increase in liabilities.

Explanation of the Entry:

- The “Cash/Bank Account” is debited with $5,000, indicating an increase in the company’s cash or bank balance due to the advance payment received.

- The “Customer Advances/Unearned Revenue” account is credited with $5,000, representing the liability incurred by the company as a result of the advance payment.

After the company delivers the computer system to the customer, the liability is reduced, and revenue is recognized. At that point, a second journal entry would be recorded to reflect the revenue recognition:

Account Debit Credit

Customer Advances/Unearned Revenue $5,000

Sales Revenue $5,000

Explanation of the Entry:

- The “Customer Advances/Unearned Revenue” account is debited with $5,000, reducing the liability associated with the advance payment.

- The “Sales Revenue” account is credited with $5,000, recognizing the revenue earned from delivering the computer system.

What is Advance payment accounting?

Advance payment accounting refers to the systematic process of recording and managing financial transactions related to upfront payments received from customers before the delivery of goods or services. It involves accurately documenting these transactions in a company’s accounting records to ensure proper financial reporting and compliance with accounting principles. Here’s a concise explanation in 10 sentences:

- Definition: Advance payment accounting entails the proper handling of financial transactions where a company receives cash or assets in advance from customers for products or services that will be provided in the future.

- Liability Recognition: Such advance payments are initially recorded as liabilities on the company’s balance sheet, under accounts like “Customer Advances” or “Unearned Revenue.”

- Journal Entries: A company creates journal entries for advance payments by debiting the cash or bank account to reflect the increase in assets and crediting the corresponding liability account to record the obligation.

- Revenue Recognition: As goods are delivered or services are performed, the liability decreases, and the corresponding revenue is recognized by debiting the liability account and crediting the appropriate revenue account.

- Matching Principle: The process adheres to the matching principle in accounting, ensuring that revenue is recognized when earned and directly associated with the related expenses.

- Financial Reporting: Advance payment accounting maintains accurate financial records, providing transparency and accountability in financial reporting, which is crucial for stakeholders, investors, and regulatory compliance.

- Accrual Accounting: It aligns with the accrual accounting method, where transactions are recorded when they occur, rather than when cash is received.

- Complex Transactions: Advance payment accounting becomes particularly relevant in industries with long production cycles or customized orders, where customers provide upfront funds to secure their orders.

- Risk Mitigation: It helps manage potential risks such as order cancellations, non-delivery, or changes in customer requirements, as the company has received compensation for its commitment.

- Revenue Management: Proper advance payment accounting ensures that a company’s financial statements accurately reflect its financial position, helps prevent financial misstatements, and supports effective revenue management and cash flow planning.

In essence, Payment accounting plays a pivotal role in accurately recording and managing customer advance payments, ensuring proper revenue recognition, and maintaining the integrity of a company’s financial records and reports.

In summary, a customer payment journal entry involves recording the initial receipt of cash or bank transfer as a liability in the “Customer Advances” or “Unearned Revenue” account. Once the goods or services are delivered, the liability is reduced, and revenue is recognized through a corresponding journal entry.

- Check here the ACTouch’s ERP Features

- How to implement an ERP Software that’s easy and quick to do?

- Problems that are faced by an ERP implementation

For a FREE ERP demo, send an email to sales@actouch.com

|