Accounts Receivable Dashboard: Benefits and Examples

This addresses the requirements of display of all the Accounts Receivable Receipts made, take print or send email to your Customers or print and keep the records.

What Is Accounts Receivable (AR)?

Accounts Receivable, often abbreviated as AR, refers to the outstanding payments or funds that a company is entitled to receive from its customers or clients for the products or services it has provided. AR represents the short-term credit extended by a business to its customers and is considered one of the most important assets on a company’s balance sheet.

It shows the Financial Health of your company at one place with total Customer Outstanding Balance / Individual Customer receivable balance with invoice details.

Example: Let’s consider a small business named XYZ Furniture Store. If a customer purchases a sofa set for $1,000 and agrees to pay for it in 30 days, the $1,000 becomes part of XYZ’s accounts receivable until the customer pays the bill.

Note – In few customer cases, where a same Customer also supplies few Raw Materials to you and he is your Supplier / Vendor. In this case, you need to consider your Accounts payable details and make a NET amount as Receivable or Payable.

What Is an Accounts Receivable Dashboard?

An Accounts Receivable Dashboard is a visual representation of the financial data related to a company’s outstanding receivables. It provides a comprehensive and real-time view of the accounts receivable process. This dashboard typically includes key metrics, graphs, and charts that help businesses track and manage their outstanding invoices, customer payments, and aging of receivables.

Example: XYZ Furniture Store’s AR dashboard might display the total outstanding receivables, a breakdown of customers with unpaid invoices, and a graph showing the trend of receivables over the last six months.

There are few accounting software that helps to identify cash cycle details with company cash position with company’s financial health at one place. Most of these tools have an ability to do a real-time updates and based on the transaction could able to generate historical trends / payment trends etc.

Why Is an Accounts Receivable Dashboard Important?

Importance of AR Dashboard is as below

a. Financial Control: An Accounts Receivable Dashboard is crucial for maintaining financial control within a business. It provides a clear overview of the outstanding payments, allowing companies to align their financial planning with the realities of their cash flow.

b. Timely Collections: For businesses, the ability to identify overdue invoices and track the progress of collections is vital. An AR dashboard provides insights into which invoices are overdue and need immediate attention.

c. Customer Insights: An AR dashboard helps businesses analyze the payment behavior of different customers. This can lead to more informed decisions about credit policies, payment terms, and which customers to extend credit to.

What Are the Benefits of an Accounts Receivable Dashboard?

Few benefits of AR Dashboard with all data visible on the screen would be as below.

a. Improved Cash Flow: One of the most significant benefits of an AR dashboard is that it optimizes cash flow. It allows businesses to visualize when they can expect payments and, therefore, plan for expenses and investments more effectively.

b. Faster Decision-Making: Real-time data accessible through an AR dashboard enables businesses to make quick, well-informed decisions. Whether it’s altering credit terms, adjusting collection strategies, or addressing customer concerns, the dashboard provides valuable insights.

c. Reduced Bad Debts: Identifying high-risk customers early and actively managing collections can significantly reduce bad debts. The AR dashboard helps in spotting potential issues before they escalate.

d. Enhanced Customer Relationships: By proactively managing receivables, businesses can provide better customer service. They can address customer issues promptly and maintain positive relationships even when collection efforts are necessary.

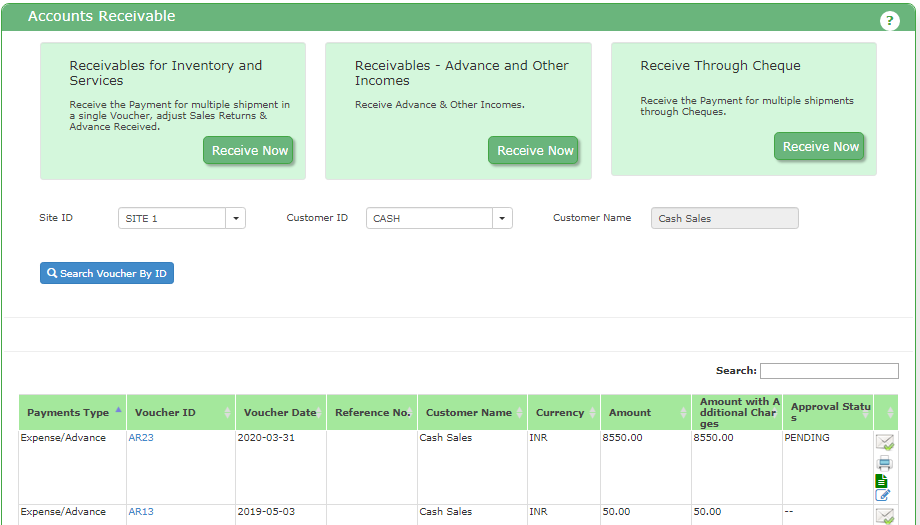

In ACTouch ERP, the Accounts Receivable Dashboard has 3 sections

- Receivables – Inventory & Services – Helps to receive payments against the Invoice.

- Receivables – Advance and Other Income – Helps to register other incomes like Interest receipt against the FD or some other investments or any advance receipts from Customers.

- Accounts receivable – Receive through Cheque – This helps to do the bulk invoices and adjust the advances, credit notes etc at one go. Application will take the FIFO (First in First Out model) and close the invoices.

From the dashboard, select the Customer ID and all the Receipt Voucher list will be displayed. You can also search the Vouchers, print or email them.

|