Create Vendor master / Supplier Master is an important data activity as we capture the maximum information that helps to manage the Business, Track the Payments, his outstanding amount etc. From Statutory point of view, we need to submit more information to Govt on the Supplier with his Tax codes, PAN No etc. So we capture all these master data at one place.

Vendor Master Data Management

Vendor master data management refers to the processes, policies, and procedures implemented to effectively collect, store, organize, and maintain data related to Vendors or Suppliers. It involves creating and managing a centralized repository of vendor information, including details such as vendor names, addresses, contact information, payment terms, tax identification numbers, and more. Effective vendor master data management ensures data accuracy, consistency, and completeness, facilitating smooth vendor relationship management, procurement, and accounts payable processes.

Vendor Creation

Vendor creation refers to the process of setting up a new vendor or supplier in an organization’s system or database. This process typically involves gathering relevant vendor information, such as legal entity name, address, contact details, tax identification numbers, bank account information, and any specific contractual terms or agreements. Vendor creation is crucial to establish a formal relationship with the supplier, allowing the organization to initiate purchase orders, receive invoices, and process payments accurately.

Suppliers Master Data Management

Supplier master data management is similar to vendor master data management and focuses on the processes and practices involved in collecting, organizing, and maintaining data related to suppliers. It includes creating and managing a centralized repository of supplier information, such as supplier names, addresses, contact details, product or service offerings, contract terms, performance history, and compliance information. Effective supplier master data management helps organizations maintain accurate supplier records, streamline procurement processes, ensure regulatory compliance, and make informed supplier selection and evaluation decisions.

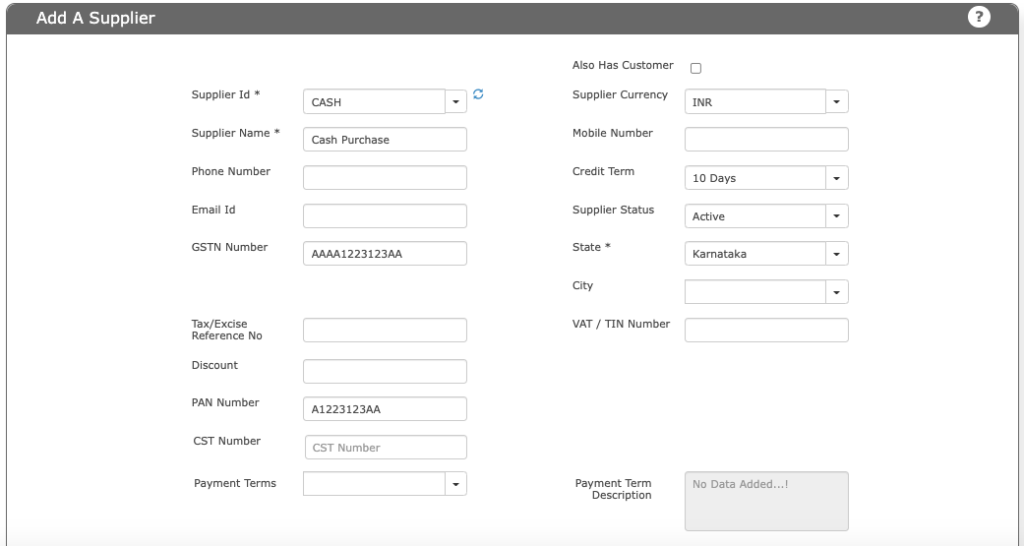

Mandatory = Yes.

We create one Default Supplier ID as “CASH” for those Clients, who wants to begin to purchase immediately.

Vendor Master data

Supplier ID – its an important parameter and its a UNIQUE Record. We don’t allow to DELETE any master data. However you can update the data by SELECTING the ID, in the screen and update other records.

Supplier Name Name, Phone number are the standard data to inputs.

“Also Customer” – This is an important data. In few cases, we have Suppliers / Vendors, who are also our Customers. In this case, from the Business perspective, we want to do the payment or settle the money after getting the net balance.

For example.

Ram has to Pay for the materals bought from us – Rs 124,000.00.

At the same time, we have to Pay for the services Ram gave to us – Rs 182,000.00.

Means, in the NET EFFECT, we have to pay the net amount of Rs 58,000 only.

Define Supplier Credit Terms, PAN NO, VAT / TIN No based on the availability.

In case of Indian GST, the STATE and GSTN NUMBER are important for the LOCAL VENDORs.

If its FOREIGN VENDOR, then select the STATE =OtherState”

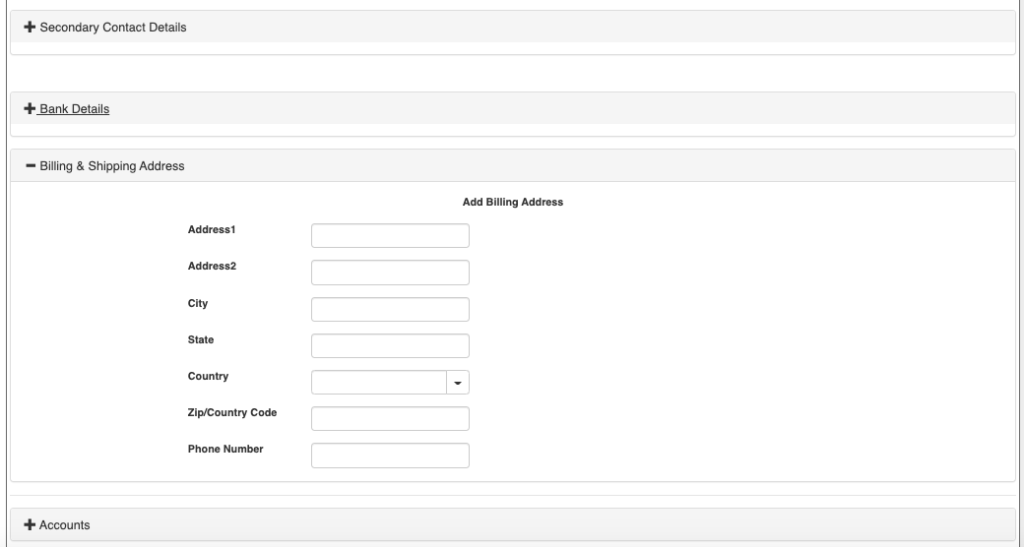

Billing Address

You can also define the BILLING address of your Supplier depending on the needs.

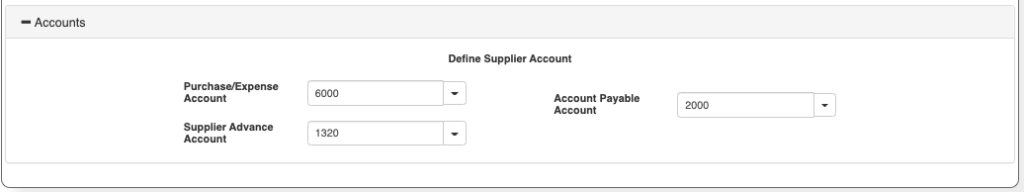

Each Suppliers Accounts or Group by ONE Vendor Creation for Financial REPORTING purpose?

This is an important section depending on how you want to define the data. A typical business transactions are as below.

- We Purchase from Vendors and have to Pay him. In the business context, we may PAY after some time. Thats called “OUTSTANDING AMOUNT”.

- Few cases, Suppliers are paid ADVANCE AMOUNT to book an item that we want to purchase.

- There are cases like DB/CR Notes, handling of Cheque returns, Sales Returns, Purchase Returns etc and these create Vouchers to reports.

The above cases, we have 2 cases and the decision on which one to use depends on each Business.

Case 1 – Do you want to see above data at ONE ACCOUNT / GL HEAD level? Means each SUPPLIER can show his NET AMOUNT that has to be Paid. Please note that each VENDOR ACCOUNTS will appear on Balance Sheet.

What to do? – Define each VENDOR, a new ACCOUNTS PAYABLE and ADVANCE ACCOUNTS and attach here.

Case 2 – You will be getting Financial Reports and do not want to SEE these RECORDS at Balance sheet level.

What to do? – Leave the ERP settings as it is.