What is Accounts Receivable?

When we sell Products / Services to our customers, we have to receive payments from Customers. Accounts Receivable is the module where we do the Receive the Customer Payments depending on the multiple document status. Accounts Receivable Process helps us to manage the business with a list of Trades receivable or Bills receivable or unreceived invoices that are yet to be paid by customers.

Accounts Receivable appears on Balance Sheet under Current Assets section. This amount also appears on the cash flow statement, Customer outstanding amount etc. As a Business Owners, we need to monitor these Financial statements to make sure our company financial health in good. Sometimes due to bad sales, we can incur bad debt and that we need to write-off depending on outstanding invoices or unpaid invoices. Its a business decision.

Sales happens with 2 types of cash flow into the business.

- Cash sales – Here we receive the cash payments immediately as we sell.

- Credit sales – Money comes after an agreed credit terms and a credit period. This is also called accrual accounting and it needs Invoices to refer to. These receivable balance appears on Balance sheet as Trade Receivables.

Receivable team always refer to the outstanding amount and tries to increase faster payments and reduce the cash conversion cycle as it helps company cash-flows. This is the very reason in many companies Credit department is always strong and they come with strict credit limits and Credit policy when Sales Team gives Sales credit to customers during sales.

Many decent Accounting software like ACTouch Cloud-Based ERP Software have the features to manage Company accounts payable, accounts receivable with Credit terms etc. It helps to arrive at Receivable Turnover Ratio, cash flow statements, outstanding ledgers etc. These softwares auto generates accounting books for Accounts department with journal entries with Income Statements etc.

Chart of accounts (COA) helps to identify unpaid bills or any individual transactions for internal controls. Objectives of accounts to book the right business expenses or Sales or revenue into proper accounts to present in Trial balance sheets.

Note: In few cases a Same PERSON could be our Customer as we all as our vendor too. IN this case, you need to PAY or RECEIVE the NET AMOUNT. So we need to be careful from which menu, is it Accounts Receivable” or “Accounts Payable” menu, we need to initiate the payments.

Check Accounts Payable Process here

It helps to answer many questions like

- What is Accounts Receivable?

- Is Accounts Receivable an Asset?

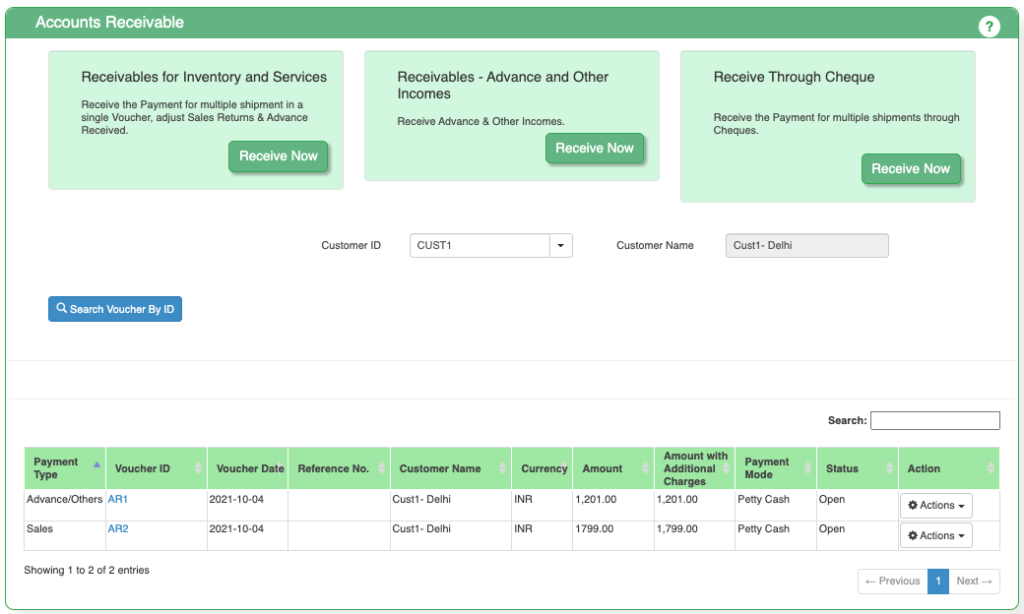

Accounts Receivable Dashboard. What is Receivable?

When you click on the “Accounts Receivable” link, the application would display the following dashboard.

Here you can do the following operations.

- Receivable the money against the Invoices that are sent to customer.

- Receive advance money from customer and create a voucher for the same.

- We built another feature for large traders, who can book the Money received by Customers and application will internally adjust the Invoices, Advances, Db/Cr notes etc based on the Dates (FIFO model)

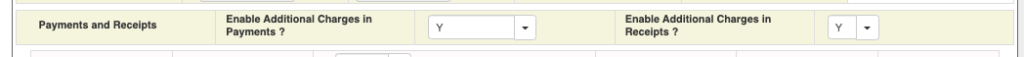

Mandatory Settings before using the ACTouch Cloud ERP Software

- General Settings – Enable the Accounts Receivable module sequence numbering. If you want a document serial number as “AR0001”, then setup here.

- If you need to book any additional charges, then enable the feature in “General Settings”.

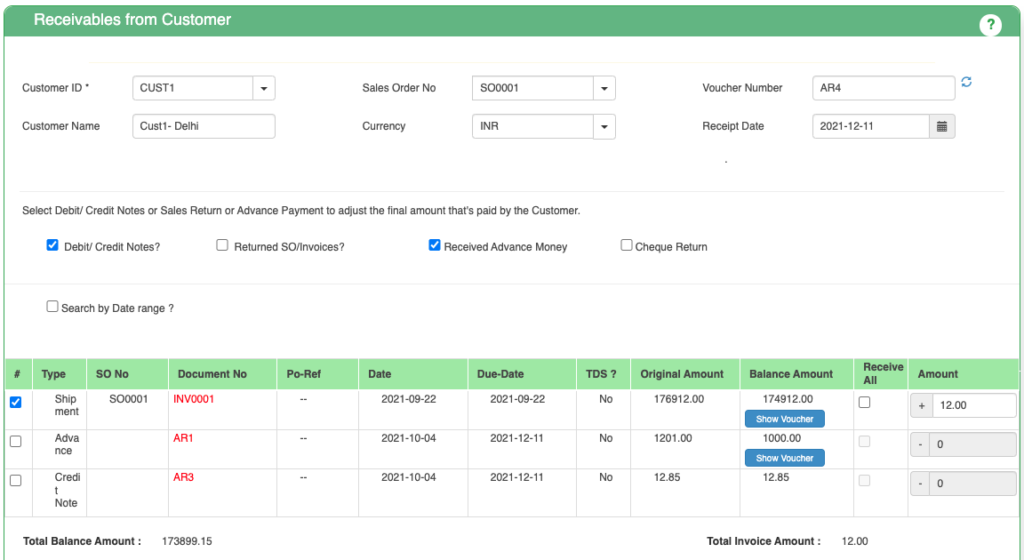

Accounts Receivable Menu / AR Process Menu.

To simplify the AR process and ensure that Accountant has the visibility of all the details, in ACTouch, we designed our AR Module where we show all the OPEN documents and the amount to receive from our customers at one go.

Following documents can be consolidated for a Single Voucher to receive the money.

- Sales Invoices – This helps us to receive the money based on the invoices that’s raised to Customer.

- Advance Received – Adjust the advances money that’s received from Customer.

- Sales Returns – Sales returns helps to track the money to be adjusted for a Customer and at the same time, helps to manage the Inventory too. We can bring the returned Stock back to Inventory.

- DB / Credit notes

- Any Cheque Bounces cases to adjust.

- Any AMC Invoices that needs to be adjusted.

ACTouch ERP helps to take all the above documents into consideration and settle the Final Amount from customer at one go. If you have any Bank charges or any payments to be adjusted then it can be done here.

AR Process Menu – Accounts Receivable Field Details.

These are the data related to the Main portion where we select the Invoices, Sales Retrurns etc.

| SL no. | Field ID | Field name | Mandatory | Field description and how it helps? |

| 1. | Site ID | Branch | Yes | It gives the branch from where the work order is generated. |

| 2. | Customer ID | Customer ID | Yes | It is a unique identification number given to each Customer. |

| 3. | Customer Name | Name of the Customer / Party | Yes | It gives the name of the customer. |

| 4. | Sales Order No | Sales Order Number | Yes | This is the Sales Order Document number, a unique number to recognize the document. We can have the Invoices or any other documents related to a specific Sales Order only. |

| 5. | Currency | Currency | Yes | Document currency. |

| 6. | Voucher No | Unique number | Yes | The Voucher number is assigned to the receivables from the customer. |

| 7. | Debit/credit Notes | Debit /Credit commercial documents | No | You have an option to choose any DB/CR notes that are raised to this Customer to consolidate as part of final Customer settlement. |

| 8. | Returned SO/Invoices? | Sales returns order | Yes | Sales Return order is created with reference to that particular sales order. |

| 9. | Received Advance money | Amount received in advance | No | It is the amount received Advance for products by the buyer to the seller. |

| 10. | AMC Invoice | Annual Maintenance Contract Invoice | Yes | Annual Maintenance Contract is the maintenance service which is offered by the manufacturer to the buyer. |

| 11. | Cheque Return? | Cheque Return | Yes | You have an option to choose any adjustments to the cheques returned and claim that money from Customer. |

| 12. | Search by Date range | Searching the sales invoices by date | Yes | It gives an option to search sale invoices between dates. |

| 13. | From Date | From date for sales invoice search | Yes | This gives the option for selecting the starting date from which the search for sales invoice can be made. |

| 14. | To Date | Last date for sales invoice search | Yes | This gives the option for selecting the last date by which the search for sales invoice can be made. |

| 15. | Type | Shipment invoice | Yes | This gives the type as invoice shipment. |

| 16. | SO No | Sales Order Number | No | SO Number against which the voucher or Invoices are made. |

| 17. | Document No | Voucher ID | Yes | It gives the Voucher Identification Number. |

| 18. | Po-Ref | Po-Reference Number | Yes | It gives the Purchase order reference number, if any. |

| 19. | Date | Sales Invoice Date | Yes | It provides the date on which the sales invoice was generated. |

| 20. | Due-Date | Due-Date | Yes | It provide the date by which the payment has to be made by the customer. |

| 21. | TDS? | Tax Deduction at Source | Yes | If any TDS amount was deducted as part of the Invoice itself? |

| 22. | Original Amount | Amount paid to the supplier | Yes | Total Invoice amount to be received by customer. |

| 23. | Balance Amount | Amount paid by the buyer | Yes | After a partial payment done by Customer, it gives the remaining amount to be received or adjusted. |

| 24. | Receive All | Check-box to receive 100% payment | No | Helps to choose all the remaining money to be received from customer. |

| 25. | Amount | Amount | Yes | It gives the total amount of money the seller intends to receive the original total amount from the Buyer. |

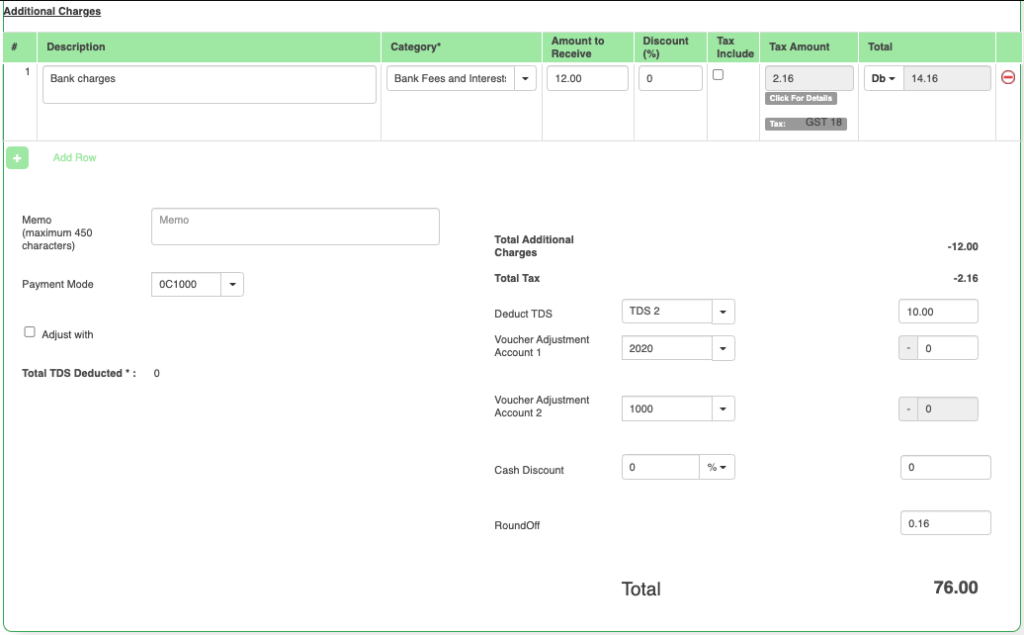

Second half of the AR Process menu, shows the features to handle the below needs.

- If any bank charges to be booked? You can also add the Taxes to the charges.

- You can select the TDS Account to adjust the TDS amount to be DEDUCTED at the time of RECEIPT of payments. Many customers do deduct the TDS amount at the time of PAYMENT and submit that amount to Government.

- Any Adjustments like you give a “Cash discount” for the early payment to customer etc. can be handled here.

- Once the final amount is arrived, decide the PAYMENT mode and Receive the money.

| SL no. | Field ID | Field name | Mandatory | Field description and how it helps? |

| 26. | Memo | Additional Details | Yes | It provides any description about the transaction made or any additional details that need to be mentioned. |

| 27. | Payment Mode | Mode of payment | Yes | This gives the mode of payment. It can be like payment through cash or Bank Account etc. It gives the drop down bar to choose the payment mode. |

| 28. | Adjust with | Any account can be chosen for payment | No | Any type of account can be chosen to pay the amount. |

| 29. | Total TDS Deducted | Tax Deducted at Source | No | This gives the option to select TDS to be deducted or not. |

| 30. | Total Additional Charges | Miscellaneous charges | Yes | This gives the total miscellaneous charges like bank charges etc. |

| 31. | Total Tax | Total Tax Amount | Yes | This gives the total tax amount for the merchandise bought. |

| 33. | Voucher Adjustment Account 1 | Voucher discount Amount on account 1 | No | Adjustment Accounts. It helps to take advantage of Cash Discount / any promo adjustment etc. can be handled here |

| 34. | Voucher Adjustment Account 2 | Voucher discount Amount on Account 2 | No | Adjustment Accounts. It helps to take advantage of Cash Discount / any promo adjustment etc. can be handled here |

| 35. | Cash Discount | No | The amount of cash discount given on the amount. This provides an option to select the cash discount as a percentage value or as amount (INR). | |

| 36. | Round Off | Rounded off amount | No | This gives the rounded off value of the amount if the amount is in decimal values. |

| 37. | Total | Total amount | Yes | This gives the Final Total amount for the purchase made by the Buyer. |

Once the data is created, we save the data and voucher is generated.