Amortization plays a vital role in the financial management of manufacturing companies. It allows businesses to allocate and track expenses related to intangible assets, optimizing their financial strategies. In this article, we will delve into the concept of Amortization, it’s types, benefits, and its significance in the manufacturing industry. Discover how ACTouch Cloud ERP Software can streamline your amortization processes, providing you with a competitive edge.

What is Amortization?

Amortization refers to the systematic allocation of the cost of intangible assets over their useful life. It involves spreading out the expense of acquiring intangible assets, such as patents, trademarks, copyrights, and licenses, over time.

In the context of manufacturing companies, Amortization refers to the process of gradually reducing the value of intangible assets through periodic expenses. It reflects the consumption or expiration of these assets over time.

What is Amortization formula?

Amortization refers to the process of spreading out the repayment of a loan or debt over a set period of time with regular payments. The Amortization formula is used to calculate the fixed payment amount required to repay a loan over a specific number of periods. It applies to loans with a fixed interest rate and fixed payment schedule.

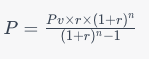

The general formula for calculating the fixed payment amount for an amortizing loan is as follows:

Where:

- PPis the fixed payment amount (also known as the periodic payment).

- PvPvis the present value or the initial loan amount.

- rris the periodic interest rate. If the annual interest rate is given, it needs to be divided by the number of periods per year.

- nnis the total number of payment periods (usually expressed in months or years).

It’s important to note that in the formula, the interest rate (rr) needs to be in the same units as the number of payment periods (nn). For example, if the interest rate is an annual rate, and payments are made monthly, the interest rate should be divided by 12 to convert it to a monthly rate.

The amortization formula helps determine the equal installment payments required to pay off the loan entirely by the end of the loan term. With each payment, the portion that goes towards reducing the principal balance increases while the interest portion decreases. Over time, the loan is “amortized” or gradually paid off.

Types of Amortization

There are two common types of amortization:

a) Straight-line Amortization: This method allocates an equal amount of amortization expense over the asset’s useful life. It provides a consistent expense pattern.

b) Accelerated Amortization: This method front-loads the amortization expenses, resulting in higher expenses during the initial years. It allows businesses to deduct a greater portion of the asset’s cost earlier.

How Amortization helps business?

Amortization offers several benefits to manufacturing companies:

a) Accurate Financial Reporting: Amortization ensures that the costs of intangible assets are properly reflected in financial statements, providing a realistic view of the company’s financial position.

b) Improved Decision-making: By recognizing the expenses associated with intangible assets, amortization assists in informed decision-making, such as evaluating profitability, budgeting, and pricing strategies.

c) Compliance and Tax Benefits: Properly amortizing assets helps businesses comply with accounting regulations and tax laws, potentially leading to tax benefits and deductions.

d) Asset Management: Amortization enables effective management of intangible assets, allowing businesses to plan for asset replacements, upgrades, or divestments.

Amortization of Intangible Assets: Intangible assets, such as patents, trademarks, and software, are crucial in the manufacturing industry. Amortization allows companies to allocate the cost of these assets over their useful life, reflecting their diminishing value accurately.

Amortization vs Depreciation – What are the difference?

While both amortization and depreciation involve the allocation of costs, they differ in terms of the assets involved. Amortization applies to intangible assets, while depreciation applies to tangible assets like buildings, machinery, and equipment.

Amortization and depreciation are two distinct accounting concepts that involve the allocation of costs related to assets. While they share similarities in their purpose, they differ in terms of the types of assets they apply to. Let’s explore the difference between amortization and depreciation, along with examples to provide a clearer understanding.

Amortization

Amortization is the process of allocating the cost of intangible assets over their useful life. Intangible assets are non-physical assets that provide long-term value to a business. Here are key points differentiating amortization from depreciation:

- Asset Types: Amortization applies to intangible assets such as patents, copyrights, trademarks, software, and licenses. These assets are legal or intellectual property rights that confer exclusive benefits to the owner.

- Allocation Basis: Amortization expenses are typically allocated using a systematic approach, such as straight-line or accelerated amortization methods. The allocation is spread over the estimated useful life of the intangible asset.

Example:

Suppose a manufacturing company acquires a patent for a new product. The cost of the patent is $100,000, and its estimated useful life is ten years. Using straight-line amortization, the annual amortization expense would be $10,000 ($100,000 divided by 10 years). Each year, $10,000 would be recorded as an expense on the company’s financial statements.

Depreciation

Depreciation, on the other hand, refers to the process of allocating the cost of tangible assets over their useful life. Tangible assets are physical assets that have a finite lifespan and are subject to wear, tear, or obsolescence. Here’s how depreciation differs from amortization:

- Asset Types: Depreciation applies to tangible assets such as buildings, machinery, vehicles, equipment, and furniture. These assets have a physical presence and are essential for the operation of a manufacturing business.

- Allocation Basis: Depreciation expenses are typically allocated based on the estimated wear and tear or obsolescence of the tangible asset. Common methods of depreciation include straight-line, declining balance, and units-of-production.

Example:

Let’s say a manufacturing company purchases a piece of machinery for $50,000 with an estimated useful life of five years and a salvage value of $5,000. Using the straight-line depreciation method, the annual depreciation expense would be $9,000 (($50,000 – $5,000) divided by 5 years).

Each year, $9,000 would be recorded as an expense to reflect the machinery’s declining value.

In summary, the main difference between amortization and depreciation lies in the types of assets they apply to. Amortization pertains to intangible assets, while depreciation pertains to tangible assets. Both concepts serve to allocate the costs of assets over their useful lives, enabling accurate financial reporting and expense recognition. Understanding these distinctions is crucial for effective financial management in the manufacturing industry.

What is Amortised cost?

Amortized cost refers to the initial cost of an asset minus accumulated amortization. It represents the remaining value of an asset after deducting its accumulated amortization expenses.

Amortization expense Journal entry:

To record amortization expenses, journal entries are made as below. These are passed as Journal Entries in the Accounting System.

- Debit – The amortization expense account

- Credit – The accumulated amortization account.

Amortization of Intangible Assets:

Amortization applies to various Intangible Assets in manufacturing companies, such as:

a) Intellectual Property: Amortization helps allocate the costs of patents, copyrights, and trademarks, which protect innovations and brand assets.

b) Software and Technology: Businesses can amortize the costs associated with software development or acquiring technology licenses.

c) Contractual Rights: Amortization allows for the systematic allocation of costs related to leasehold improvements, franchise agreements, or licensing agreements.

Amortization is a fundamental aspect of financial management in manufacturing companies. It enables accurate financial reporting, informed decision-making, compliance with regulations, and effective asset management.

FAQ on Amortization

1. What is amortization?

Amortization is the process of spreading out the cost of an intangible asset over its useful life. It is a systematic way of allocating expenses to match the revenue or benefit derived from the asset.

2. What types of assets are typically amortized?

Intangible assets are commonly subject to amortization. These include patents, copyrights, trademarks, software, licenses, and goodwill.

3. How is the useful life of an intangible asset determined?

The useful life of an intangible asset is estimated based on factors such as legal protection, technological advancements, market conditions, and contractual agreements.

4. What is the difference between amortization and depreciation?

Amortization applies to intangible assets, while depreciation applies to tangible assets. Amortization allocates the cost of intangible assets, while depreciation allocates the cost of tangible assets.

5. How is the amortization expense calculated?

The amortization expense is calculated by dividing the cost of the intangible asset by its estimated useful life. Different methods, such as straight-line or accelerated methods, can be used to calculate the amortization expense.

6. Can the amortization period be changed?

The amortization period is typically determined at the time of acquisition and is based on estimates. However, if there are significant changes in the asset’s useful life or value, the amortization period may be revised.

7. How does amortization affect financial statements?

Amortization is recorded as an expense on the income statement, reducing the company’s reported profit. It also reduces the carrying value of the intangible asset on the balance sheet.

8. Can amortization be tax-deductible?

In some cases, amortization expenses can be tax-deductible. However, tax laws vary by jurisdiction, and it is recommended to consult with a tax professional for accurate guidance.

9. What is the journal entry for amortization?

The journal entry for amortization involves debiting the amortization expense account and crediting the accumulated amortization account to reflect the expense and the reduction in the asset’s value.

10. Can amortization be accelerated or slowed down?

In general, amortization is spread out evenly over the asset’s useful life. However, certain events, such as changes in the asset’s value or the decision to write off the asset, can accelerate or slow down the amortization process.

With ACTouch Cloud ERP Software, you can streamline your amortization processes, ensuring efficiency and accuracy. Invest in ACTouch today and unlock the full potential of your manufacturing business through optimized amortization practices.